Did BITCOIN (BTCUSD) fail as a good hedge against inflation?

Okay, so in the last two months, things have gone from bad to worse (who wasn't expecting that post 2020). The Ukrainian/Russian escalation has caught the attention of all.

Some joke that in 48 hours, Putin has managed to single-handedly remove Covid19. And if you look around, restrictions are being removed or repealed in many countries. Media has caught onto something new to de-sensitize us.

I said to my friend who was asking about normalcy returning - I said it will only happen when we stop wearing masks and get back to being social human beings. The fear or psychosis that has been created has caused more damage than people can comprehend.

But there are underlying currents in the market that can only be seen from a birds-eye view. If you're glued to media channels or social media, things are going to enrage you and you'll miss it.

There's a reason why I called this newsletter and site - ZENCAPITA. It was to bring about a Zen mindset, that when things are falling apart around you, you would be calm enough to navigate it with clear thinking.

I digress.

While inflation concerns were rising from the US, and now globally. Governments needed a distraction. They got one, in the form of Ukraine/Russia. Everyone's eyes are on that now, discussions galore. But it doesn't take away from all the printing that the US Fed has been doing, and the massive amounts of debt.

Their only tool is controlling interest rates, and when you only have a hammer, everything looks like nail. So while they want to increase interest rates, how much and by when, especially when the economy is recovering is a challenge.

But some interesting developments emerged as well. In Canada, where truckers are protesting, people started supporting them with cryptocurrency, especially after the crowdfunding site, refused to transfer money after supporters contributed to it. This is tech at its worst.

The Canadian government went a step further, and from what I understand, they've seized the accounts of those who funded with cryptocurrency. So much for crypto as a currency. This can happen and will happen.

And here's an interesting quote from Edward Snowden, the wanted.

Governments claiming the authority to *freeze people's bank accounts* because they want to crush a protest movement is tyrannical and obscene. If you would oppose China or Russia doing it, you must oppose Canada doing it.

— Edward Snowden (@Snowden) February 20, 2022

Very glad @CanCivLib exists.https://t.co/wXBCLdtlbt

Now across the other side of the world, as Ukrainian/Russian situation escalated into a war. The Ukrainians called for support through cryptos. I understand they raised over $50 million to support the war efforts.

Apparently, they've already spent $15 million to buy supplies and protective equipment.

Hmm... I wonder how those who supported the war efforts will be seen down the line, as terrorists or freedom fighters!?

What you see above, is the different use cases of cryptocurrency. For all that hoopla that governments were saying that cryptos support money laundering and nefarious activity, we can see it is being used for good and bad IMHO. But that is the case with any money, not just cryptos.

Meanwhile, countries are banning crypto. The Indian government seems to be totally confused what to do, as they tax it on one end, and call it illegal on the other. Interesting.

This was expected, and this is one of the reasons I sold all my cryptocurrency back on 15 April 2020. And fast forward today, I just realized a couple of things - some major banks like HDFC Bank, ICICI Bank, Axis Bank are not on the 'supported list' of banks that will allow you to buy crypto. We'll get into this in more detail for the premium subscribers, but more importantly...

Things are SWIFTLY changing.

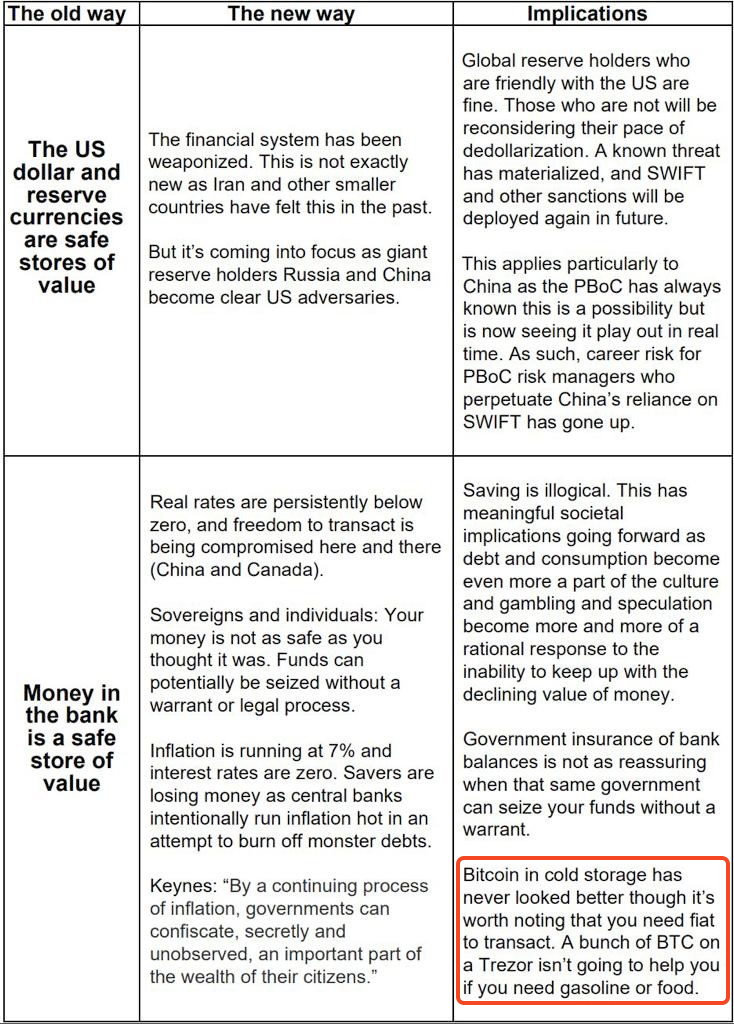

Now there is one impact that really caught my attention, and that is SWIFT banning Russian Banks. SWIFT is basically the (old) plumbing system that banks use to send messages and transfer funds. When you hear something like a financial tool being used as a negotiating tool, you've basically weaponized it.

This is worrisome. Financial tools should remain neutral and serve a purpose, if SWIFT is meant for communication as well as sending currency, then communication has to be open, otherwise, people will lose trust. And once trust is lost, it is difficult to regain. It is the key to doing business.

The reason for the introduction of cryptocurrency, specifically Bitcoin was following the 2008 financial crisis, where people lost trust in banks.

And now, when I look at all that has happened above, I cannot but stand in shock as to what is happening.

While Bitcoiners stick to their optimism of it going to the moon, they have to talk their book up, because they have a vested interest in seeing it succeed.

I want to take a more rational approach.

Understand the barriers to cryptocurrency

First, you'll have to understand three factors that will prevent Bitcoin or cryptos from becoming mainstream.

One factor was user experience, which is changing, though people still like to entrust others with their money, rather than keep the keys to their vault or under their mattress. That's human nature.

The other two factors were 1) Governments and 2) Banks or more specifically Central Banks that are controlled by governments. No government wants to give up its control of currency printing. They will do everything in their power to retain that.

Now, the debate goes into whether technology will succeed or government will succeed. I am betting that governments will succeed, in fact, they will use the technology to their advantage, and you can see this in the form of CBDC - or Central Bank Digital Currency.

You're already in that system, there is nothing new to it. Tomorrow we may see a future, where we deal directly with the central banks, and there is no need for a retail bank. Your transactions will all be tracked, and government can with or without cause come after you.

So where does this leave us? You might be asking, so are you buying or what?

The answer is yes, After a two-year hiatus, I wanted to test how the system works in India, even with the confusion of whether it is legal or not.

While the 30% tax on cryptos is just a way to dis-incentivize you from investing, people will invest in something they see as an opportunity, rather than be left out.

So what I've done is, this morning, bought a tiny amount of BTC & ETH to start the testing process. I will be sharing the outcome with our premium members. If you're not a member yet, sign up today. (I also share the buying price, and what price see it going to.)

But before I go, I wanted to share two things for you to read and study. And the last point in this table below (this was forwarded to me, so don't know the author, happy to give credit where it is due):

Bitcoiners (for lack of a better word, who heavily promote Bitcoin as the best thing since sliced bread) don't understand this point enough (or don't want to accept it).

If you measure BTC in USD, then you still believe in the USD part. And you still need to convert into a fiat currency to use cryptocurrency.

Consider cryptocurrency (BTC, ETH, XRP) as a trading asset, like you would oil or copper, or even gold - though, with gold, you can at least melt it into jewelry!

And talking about Gold, many gold bugs have taken up the anti-Bitcoin stance, that when the war broke out, Gold moved up, yet Bitcoin fell. Here's a nice comparison courtesy Weekend Investing's Alok Jain who is a gold bug himself!

So, does Bitcoin do well as a hedge against inflation? The answer will depend on the time frame you look at. A war situation is an event, but increasing inflation over time, will show whether it is a hedge or not.

I managed to spark a massive debate on Gold vs. Bitcoin in one of my charts which was actually on a big bullish move in Gold. The editorial team at TradingView picked this as something worth looking at. I hope you study it well, and read the comments while you're there!

Stay tuned for my next update for premium members. Remember, we're thinking with a 10 year horizon, not just a short few months or years.

Member discussion