Equity Linked Saving Schemes (ELSS) - 2022 Update

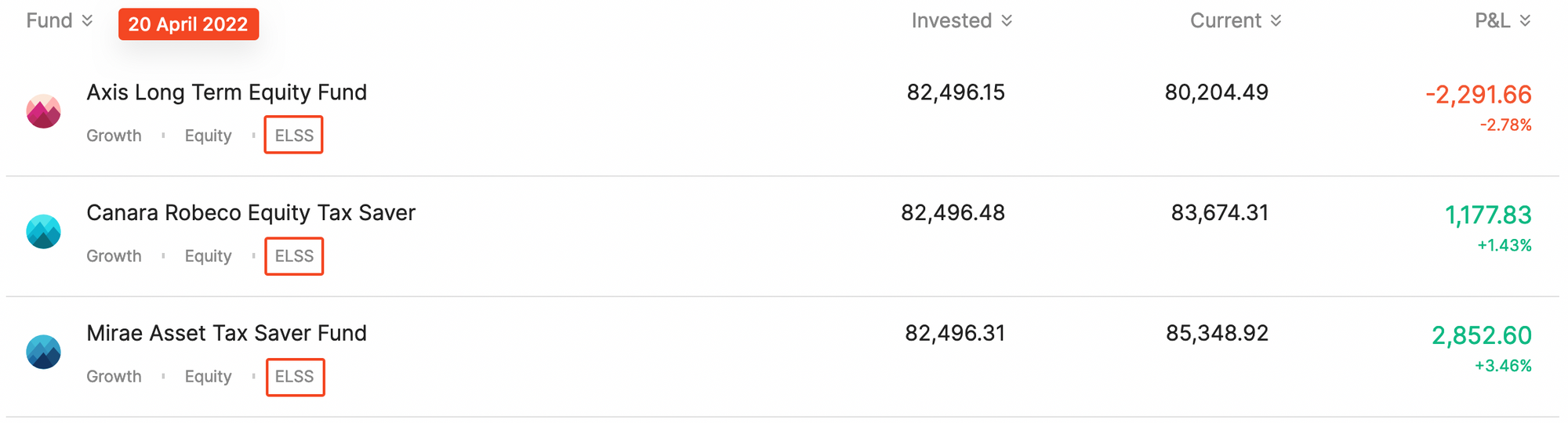

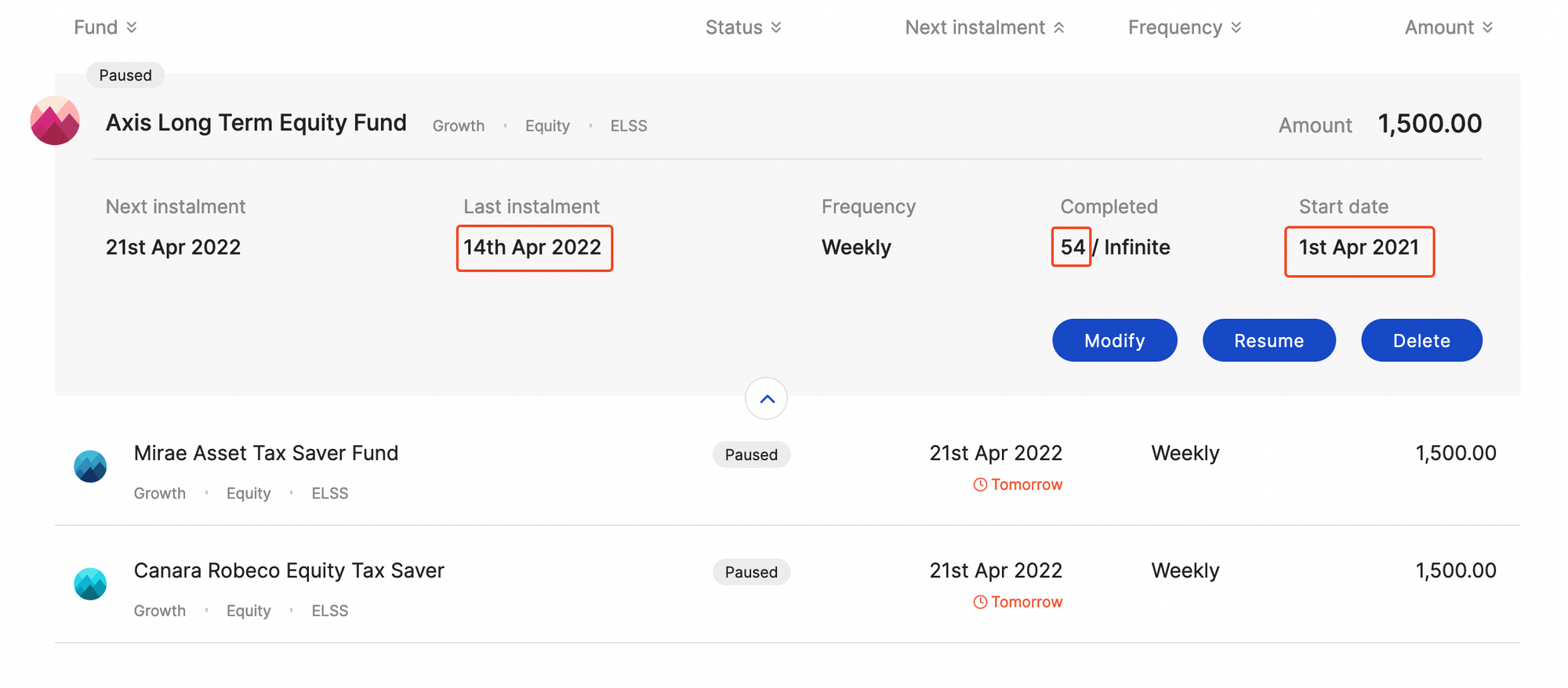

Last year I shared the three ELSS (Equity Linked Saving Schemes) mutual funds that I invested in via a SIP (Systematic Investment Plan). After 52 weeks of investing, I'm happy to say, it was a waste.

If you haven't read the post, or don't recall - click below to read.

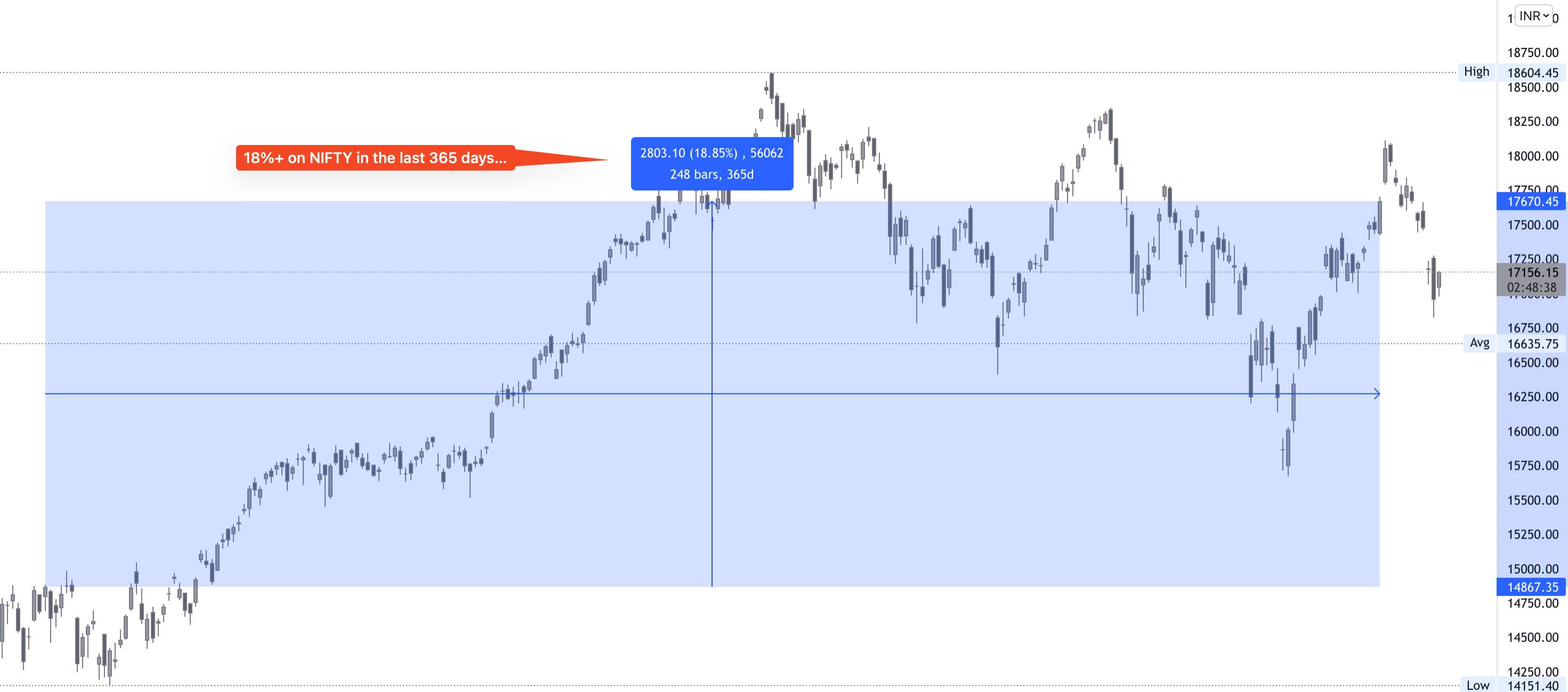

So, I did touch upon this: while you can save tax via Section 80C, the question did arise is what if the markets corrected and you see a loss. Would it be worth the trouble of investing in an ELSS? Well, markets didn't hover, on the contrary, they rose in the last year and the results speak for themselves.

So looking at the above, you'd be scratching your head!! I mean less than 4% return on an ELSS mutual fund. Huh!?? I mean, c'mon...

So you really need to think for yourself, as to whether it is worth it. Many will say, keep SIPing, for at least 3 years to get the benefit, and they might be right (though I would suggest SIPing for 5 years to really see a benefit in any investment).

But the results speak for themselves... the #NIFTY index during the same period went up by almost 19%, 20% say for the rounders. And my SIPing on ELSS mutual funds generated less than 4%!

To be fair, I did 54 weeks of SIPing, and the last two weeks did see a correction of 7% since the peak on 5 April 2022 (or to be more precise, had we stopped SIPing on 1 April 2022, that would be a 3% drop when looking at the NAV).

Nevertheless.

So was it really worth it?!

My point is that, if you're maxing out on your Section 80C deductions through other options, say for example insurance premium or any other deduction, then you should really reconsider whether ELSS schemes are the right avenues for you - since there are other alternatives that give a better return (I am not a fan of mutual funds, as you may know).

Keep in mind that with the new tax regime that you can opt into, where there are no deductions, rather a simpler tax rate - you may want to think over whether the government is planning to do away with deductions altogether, and just simplify the tax rate even further (preferably lower it or do away with income tax altogether in favour of GST). If so, all these deductions make no sense in the long run.

So what am I doing, well, I am stopping my SIP into ELSS schemes, since I've built some SmallCase baskets, which have generated better returns in the last one year. And I'll bump up my insurance premiums and other deductions to compensate.

This may not be the solution for you, and since I'm not a registered investment advisor, please consult your own (and all the blah blah disclaimers). I just hope that it has given you some food for thought.

If you do plan to continue SIPing into ELSS schemes, please take the last 1 year, from 1 April 2021 to 1 April 2022 and see whether the scheme has delivered 18% return or better. (I'll probably update this post later with the 1 year results of the chosen 3 schemes).

Member discussion