IPO Happiest Mind Technologies

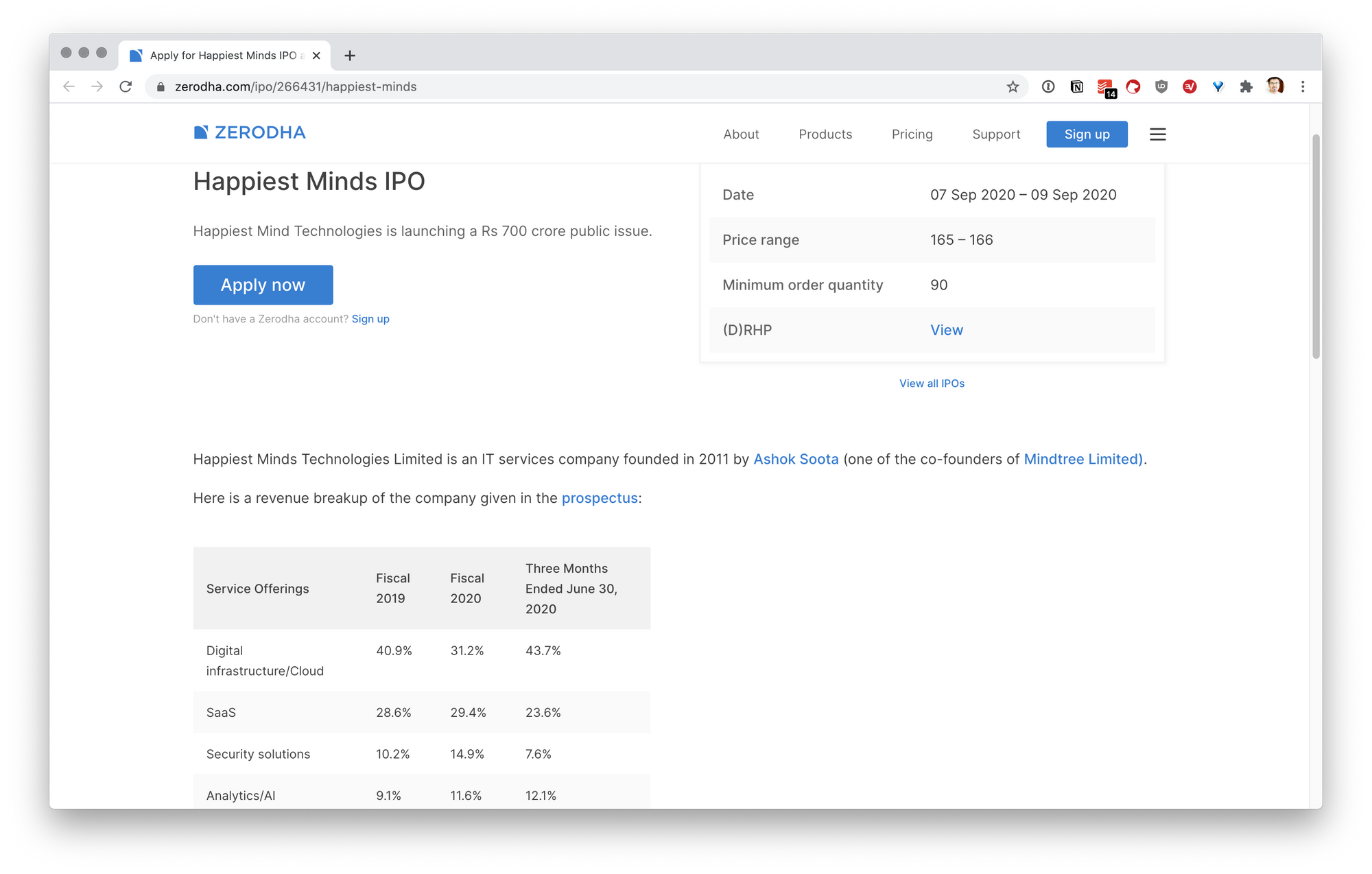

Before you think this is some crazy minded company. Hold your thoughts. This is founded by Ashok Soota, co-founder of MindTree. I believe this is his second IPO experience, so he knows how to play it well.

First off, I don't enjoy pre-IPO subscriptions. They're hit or miss. For the risk, you're better off waiting some time and then letting price discovery take place on a larger scale. Anyways, I thought I'd use Zerodha to pull this off, and it was smooth.

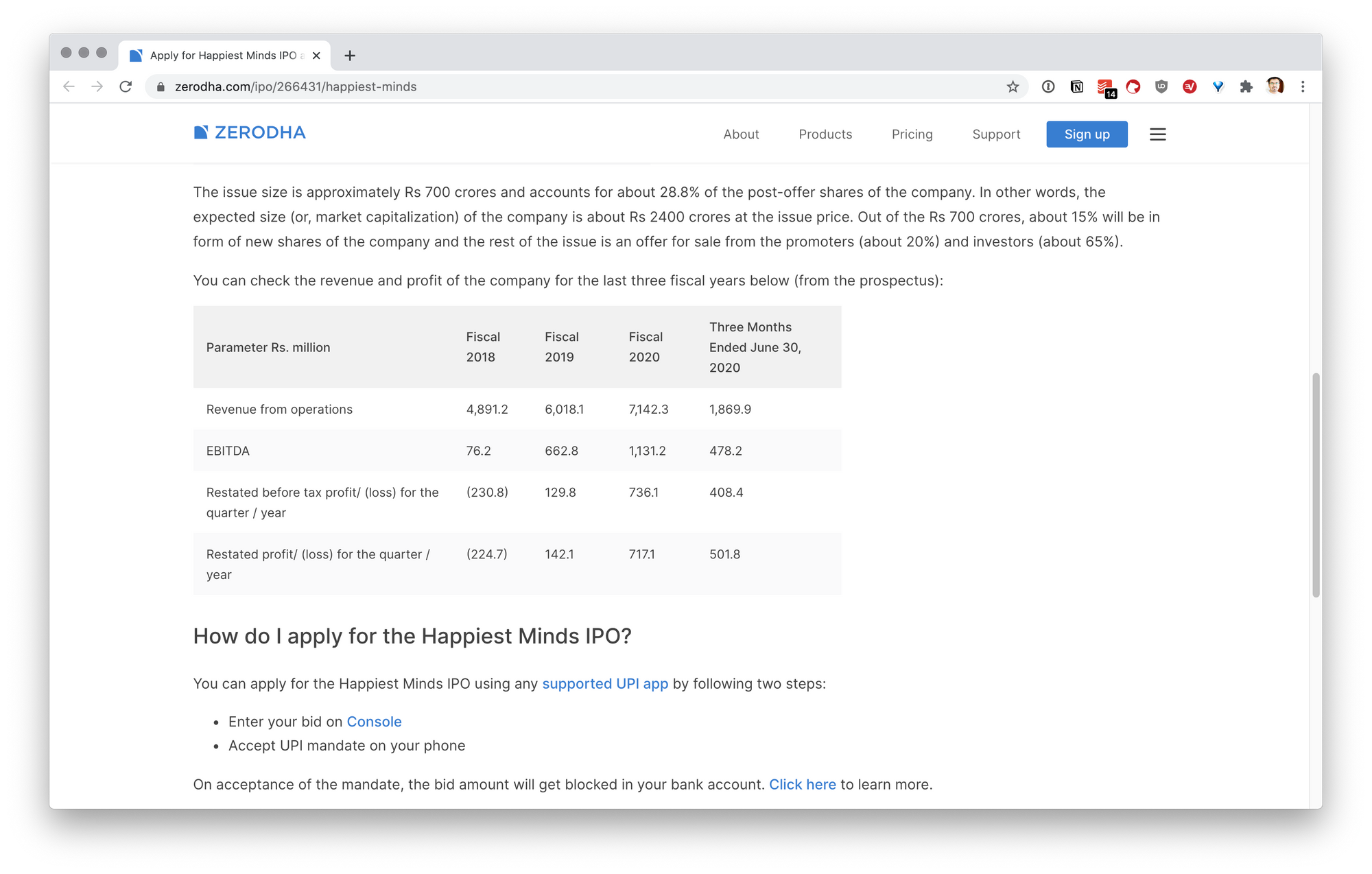

Always do your homework before investing in these upcoming IPOs. Not easy when you have limited information. But reading the RHP - Red Herring Prospectus will give you an idea about the company, at least what on earth it is doing.

Typically, people don't have time to read through this - you can't blame them. So they rely on analysts to tell you whether its good or not. And do you really think these analysts keep your best interests in mind? Think again.

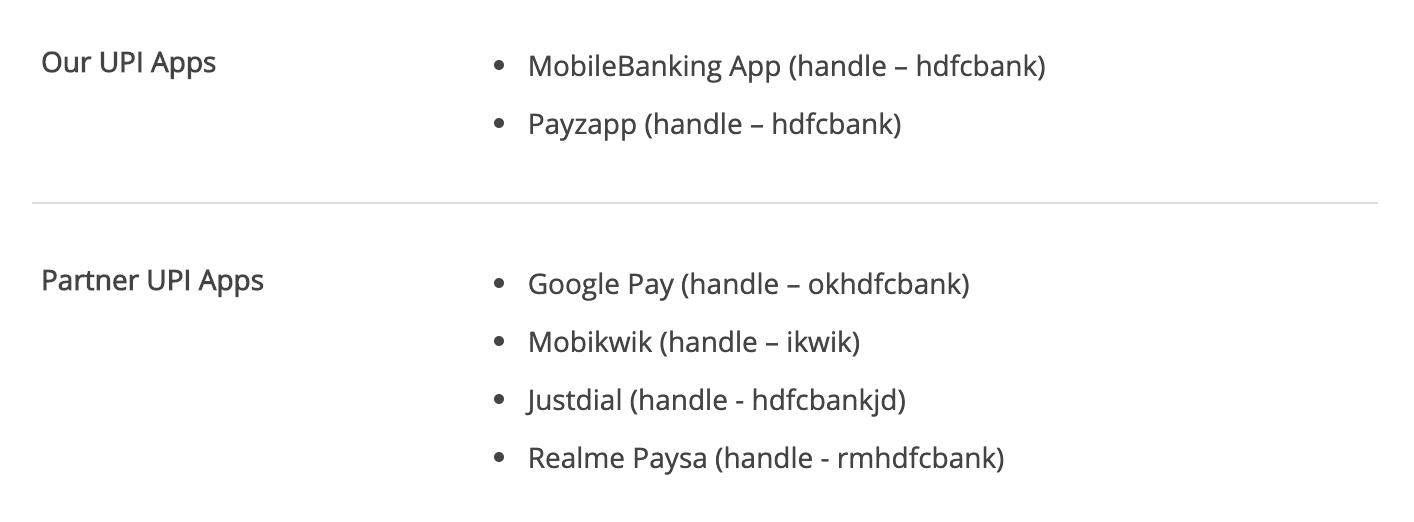

I learned a few things as I went about using Zerodha, but it wasn't related to Zerodha actually, it was related to HDFC Bank and using UPIs to subscribe.

I see a lot of people having problems with UPIs - and not surprised, each bank has their own. Some can be used for IPOs, some can't. I really don't understand the logic in this segregation - if you know, please tell me!

As a result, HDFC bank has two UPI handles - @okhdfcbank and @hdfcbank - and it took me some researching to figure this out.

@hdfcbank is HDFC Bank's UPI (that means to use on their platform, along with PayZapp - there so called "wallet"). And apparently, @okhdfcbank is used by their partners. Makes no sense why.

That's when I realized I can't subscribe to the IPO, without having another UPI app. You may ask why I didn't go for Google Pay - well, it's because GPay does not allow for Enterprise Accounts i.e. GSuite Accounts. (I noticed this weird policy of Google when trying to pay for YouTube Premium - another story, another day)

So I went ahead and downloaded BHIM UPI app. If you're outside India, you will not be able to signup as your mobile's GSM location is used. Unless you can hack your GSM location, don't use it.

The BHIM app was mediocre. After adding bank details, I just couldn't move to the next screen. Then with a good old fashioned restart of the app, managed to sign in.

Anyways, BHIM UPI is permitted for IPO purchase, you just need to connect your HDFC Bank account (which is already signed up via UPI) to BHIM. Once you've selected your preferred bank account, and your setup - head back over to Zerodha and subscribe.

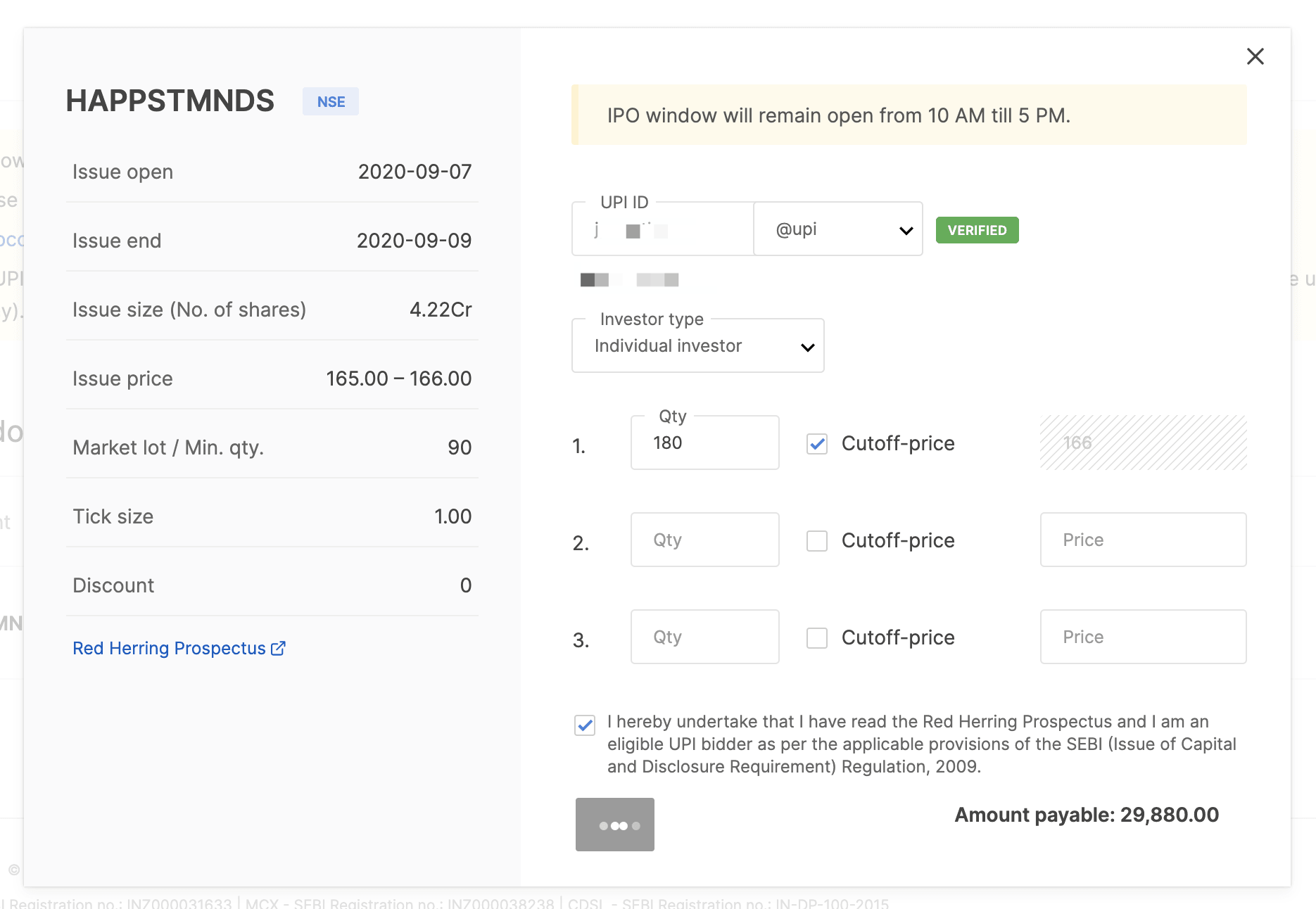

Once you're back at Zerodha's IPO section, just bid... →

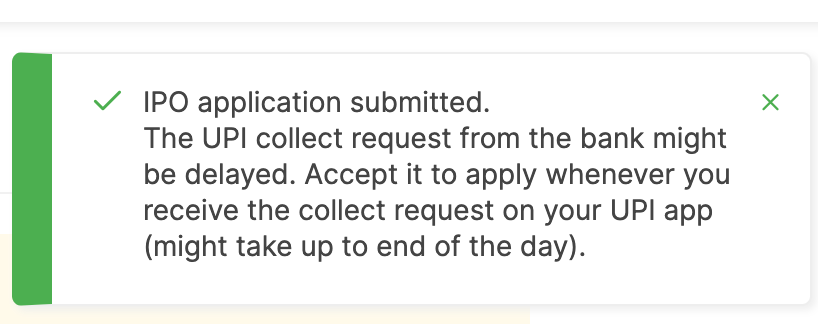

You can bid from 10 am to 5 pm. Plenty of time, once you've made a decision. I just went with the cutoff price to ensure I got something. After you've submitted, you'll get an alert (I got an error, and just retried) that it has been submitted.

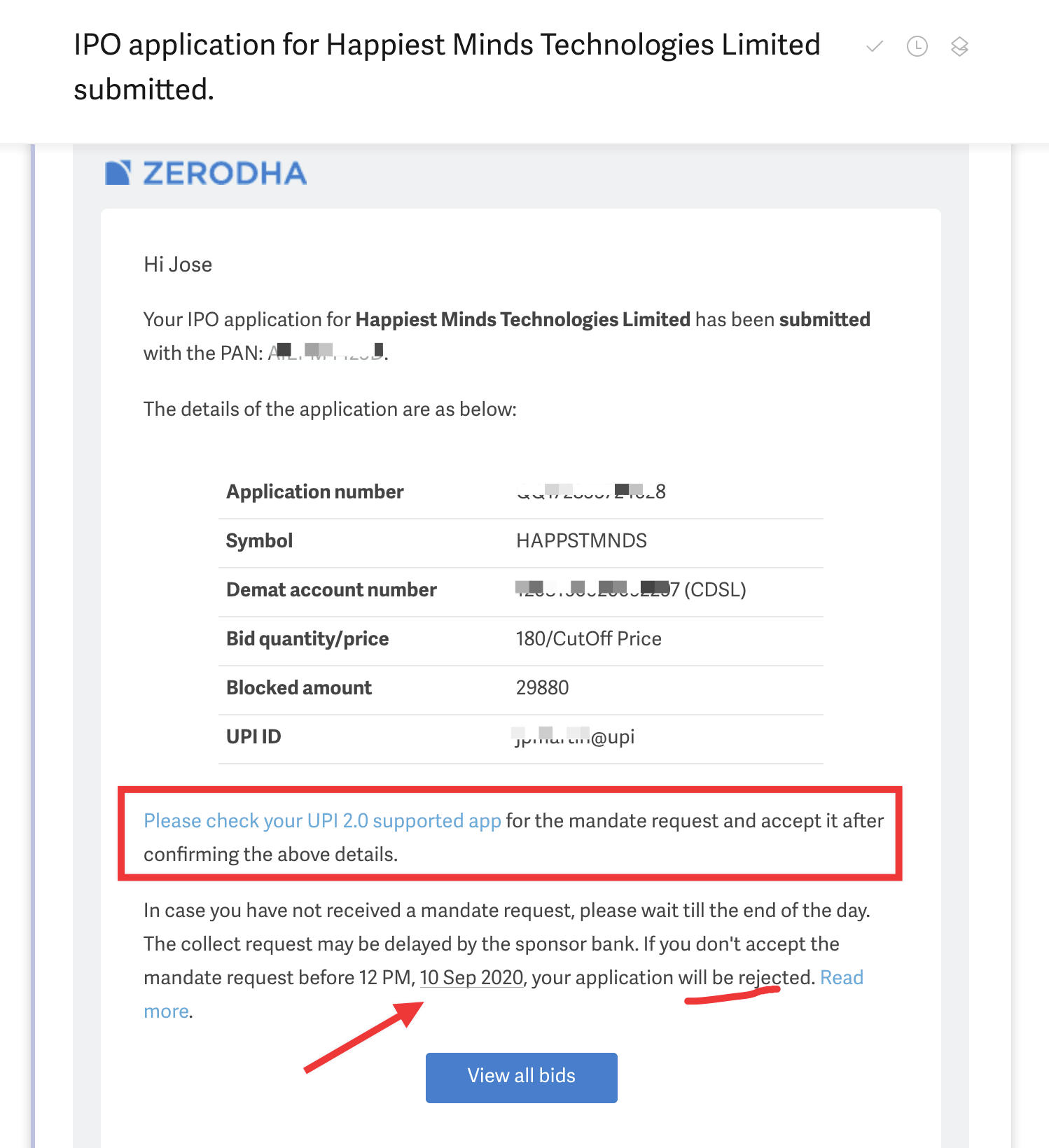

The next step is the most important - remember to check your UPI App (in this case BHIM UPI) to approve the IPO purchase. You'll get a nice reminder from Zerodha, but if you don't approve, no shares!

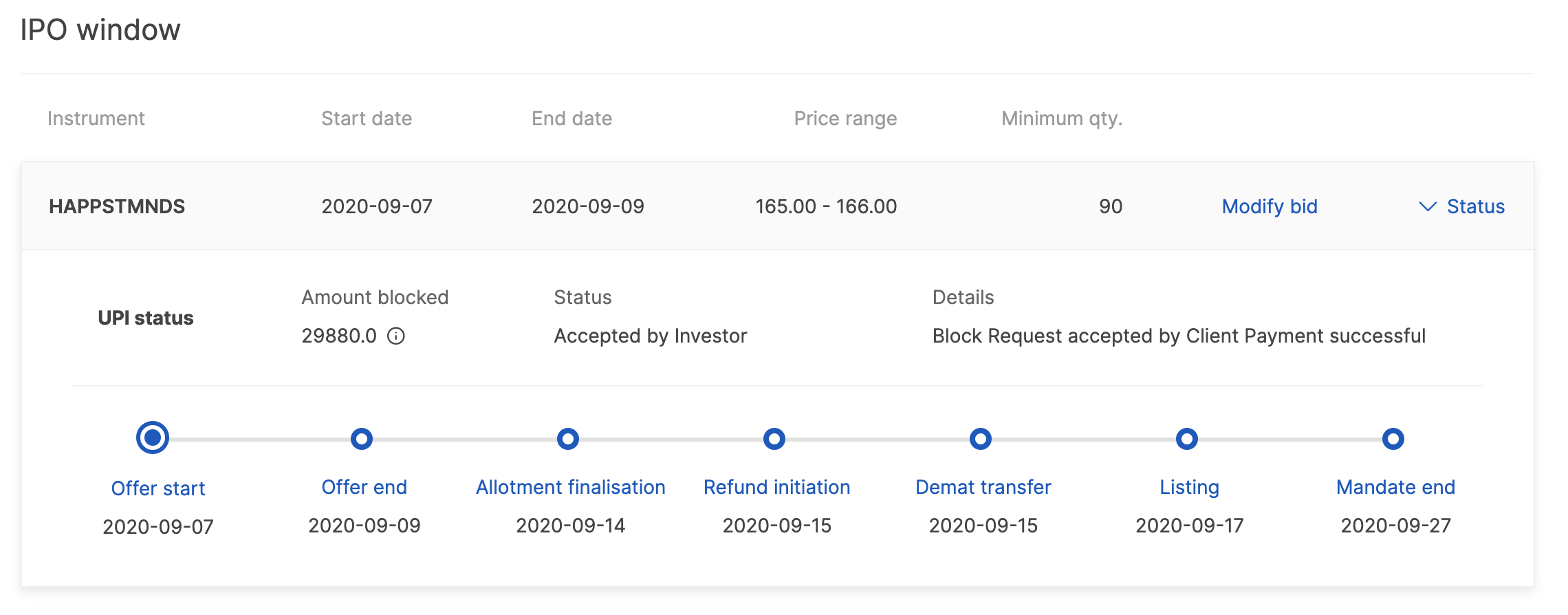

And just double check your Zerodha account, you should see something like this:

As mentioned earlier, I don't believe in IPO subscriptions. You can make more money from the market, than with these. Just think about all the steps I had to take, just to purchase some shares - and I couldn't even use the funds in my trading account! For this reason, instead of investing 1 lakh rupees, thought I'd just try out with a quarter of that - ₹ 25,000 approx.

While Zerodha has made it easier (and far better experience than subscribing through HDFC Bank / Securities) - there is still so much friction involved, because of the UPI option. Had they just given an option to subscribe to the IPO, by transferring funds via NetBanking - maybe that would have been a bit easier.

I'll update this post later on with the BHIM UPI app interface, so you get a feel of how much it needs to improve! As for now you have till end of day to subscribe to this if you like. Should you?

Update: Happiest Minds Technologies Ltd., was oversubscribed 151 times! And what makes me feel angry, is that I didn't get any shares allocated! Talk about rubbing salt on the wound!!

If you're looking to research more on IPOs before investing here are two sites that I find useful:

Member discussion