Motilal Oswal S&P 500 Index Fund - Annual Update

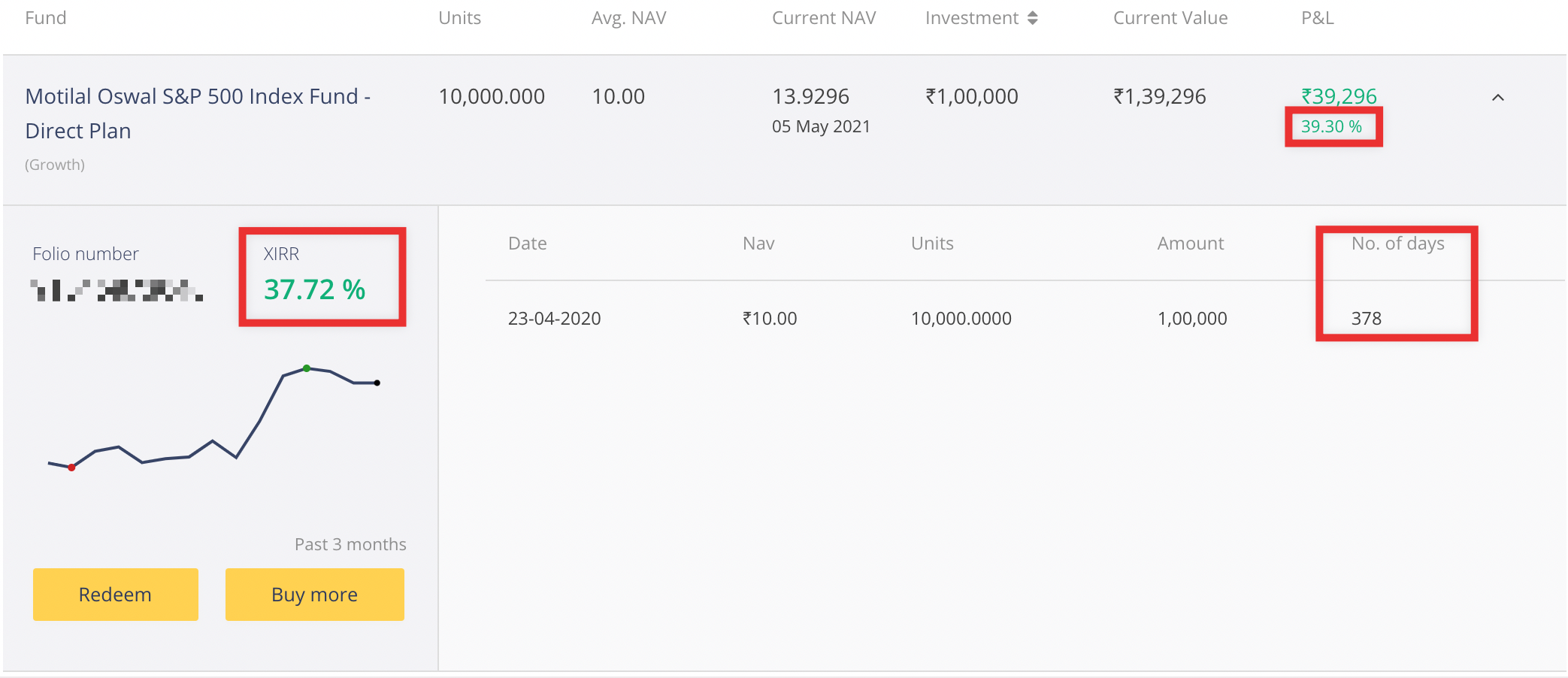

Last year (i.e. around 365 days ago) I wrote about how you could invest in the S&P 500 in the US, it was through an NFO mutual fund. And while I don't like mutual funds, this one has done well.

Whether you want to book the returns is upto, and whether you want the money now, and you can find a better avenue to put the money to use. I however, am holding onto this. If it doubles, I'll sell half - that's the general thumb rule to booking profits.

So let's have a quick look at the returns from an absolute perspective, as well as a more accurate return - using XIRR - to factor in time value of money.

Would I invest more now, as of now... no. The market is seeing all time highs, that's not an indication that things will go down, for sure. But there is a high possibility we will see a correction (not a crash), and then it will resume its trend for next few years.

However, if you have the appetite for risk, be my guest - just be willing to see a loss of 30-50% if it happens.

I'm drafting up a post on how you can invest in US stocks, through a custodian or even directly, that would be more beneficial in the long run, as you know - I hate paying an expense ratio for mutual funds.

If you're interested to become a paying member, the process is simple, just sign up below. Being a member is free, but being a paid member gives you more insight on how I'm building my wealth. Join me today...

Member discussion