Why you should use Smallcase with Dhan instead of Zerodha

The simple reason is ₹. Yes, money. For the longer reason, read on as to why you should move your Smallcase over to Dhan Broking (referral link).

Dhan Broking is a recent entrant in the discount broking space, and having watched them over the last year, I can say they're making continuous improvements and might be a worthy competition to Zerodha.

I was going through my smallcase, when curiosity struck, how much am I being charged for using smallcase, as nothing in life is free.

You may ask, why didn't you ask this earlier, before even investing. Well, in the larger scheme of things, when you're investing if the cost is nominal, you shouldn't fret over it. But that's another topic for another day.

My curiosity was spiked further, when I chatted with the Smallcase Team, to find out that Smallcase has changed the way it charges.

In simple terms, you pay 1.5% of the investment or ₹100 whichever is smaller - for lump sum investments or new investments. For SIPs, you pay ₹10 per SIP.

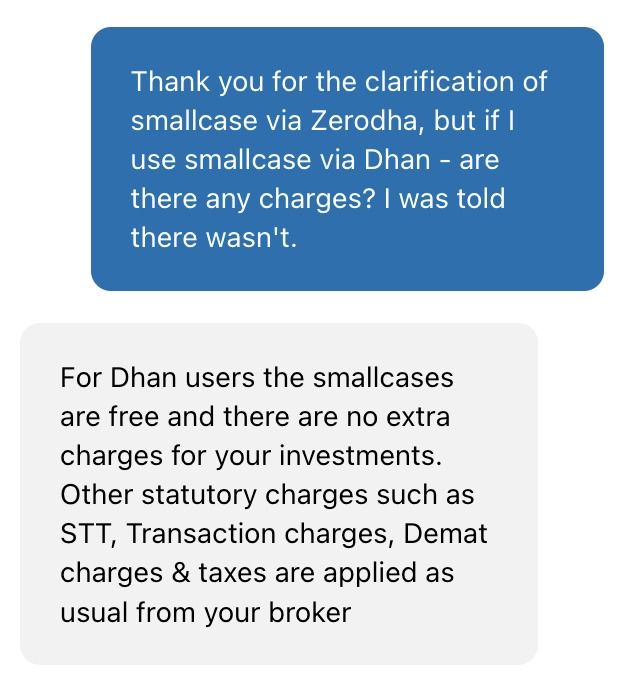

But what struck me was that when I was research more on this change, I noticed that Dhan (Broking) does not charge this, in fact it's FREE. You heard that right! The only charge you pay is to the regulator & government as their pound of flesh, for their lack of work!

I don't know if this is an initial introductory thing, or whether this is how they're marketing so they can get more people on to the Dhan platform (it might be working), but let's take advantage of it for as long as we can.

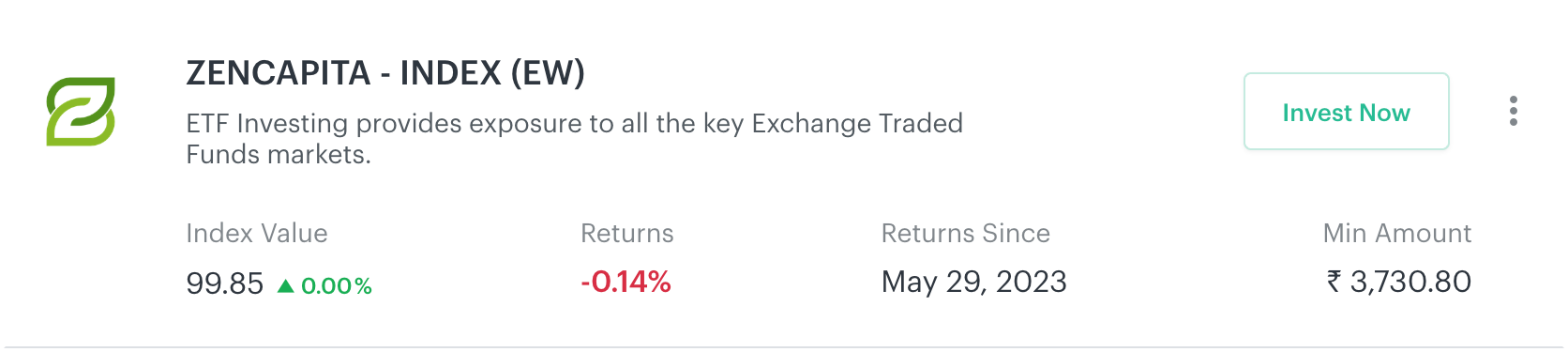

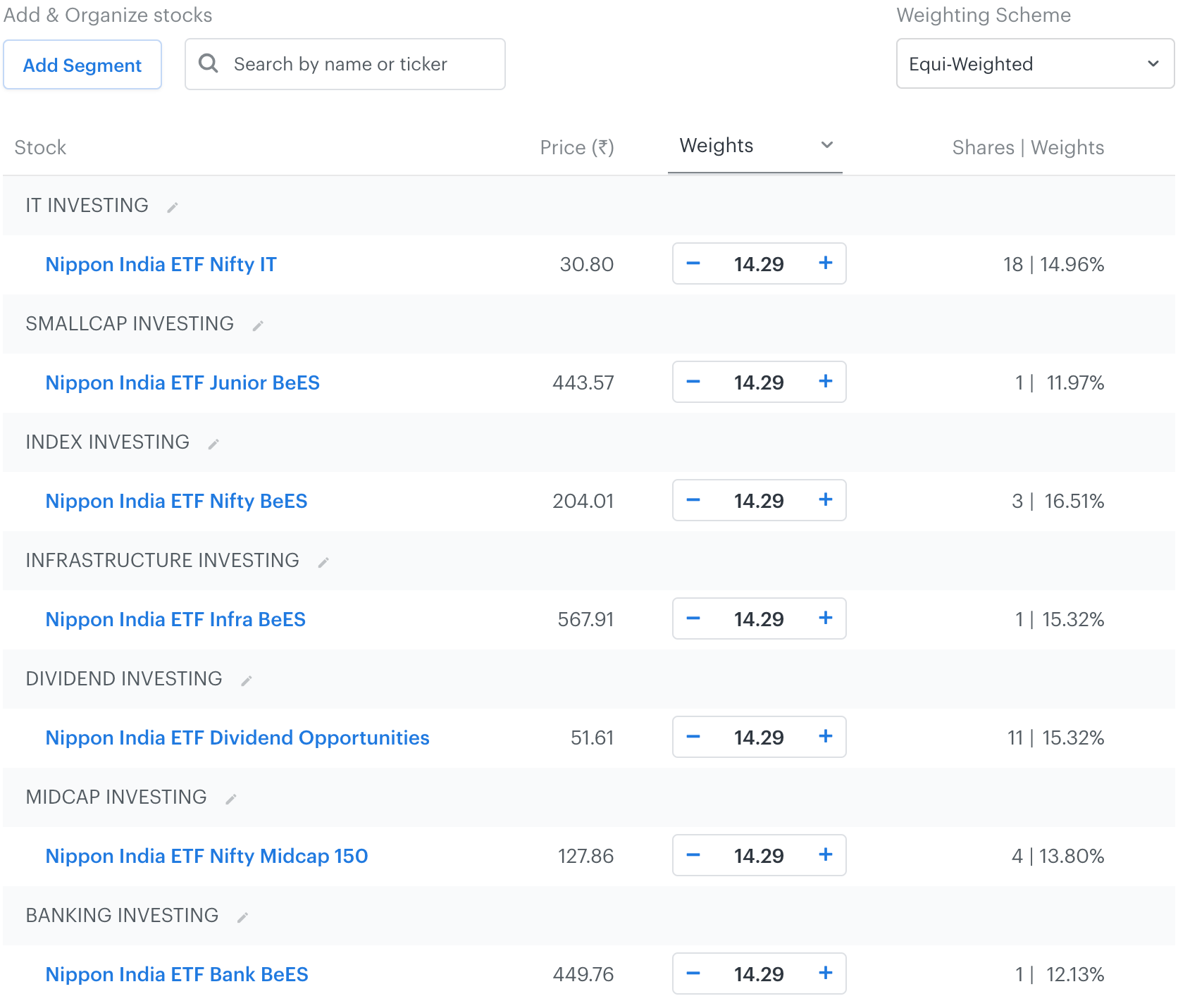

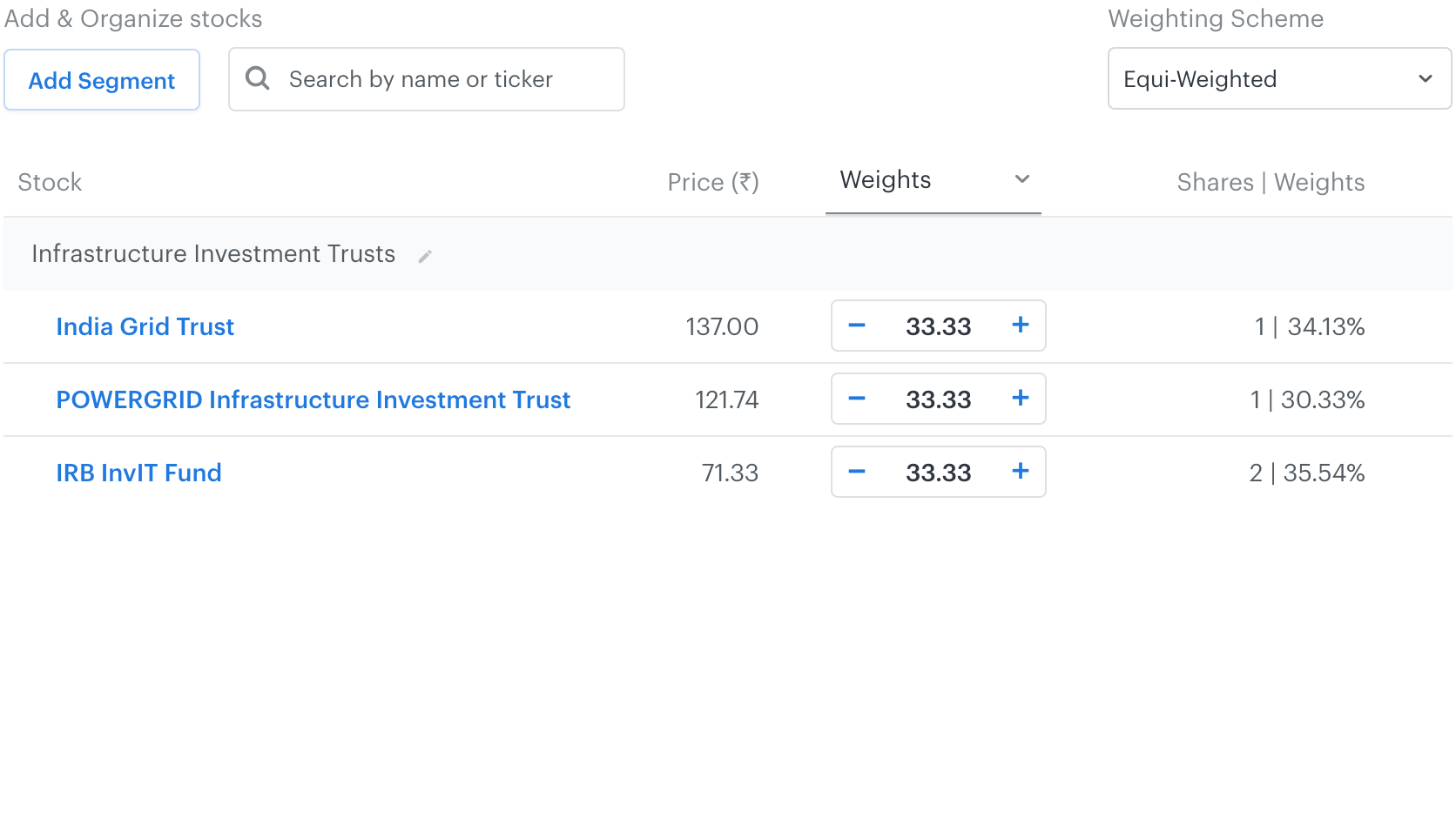

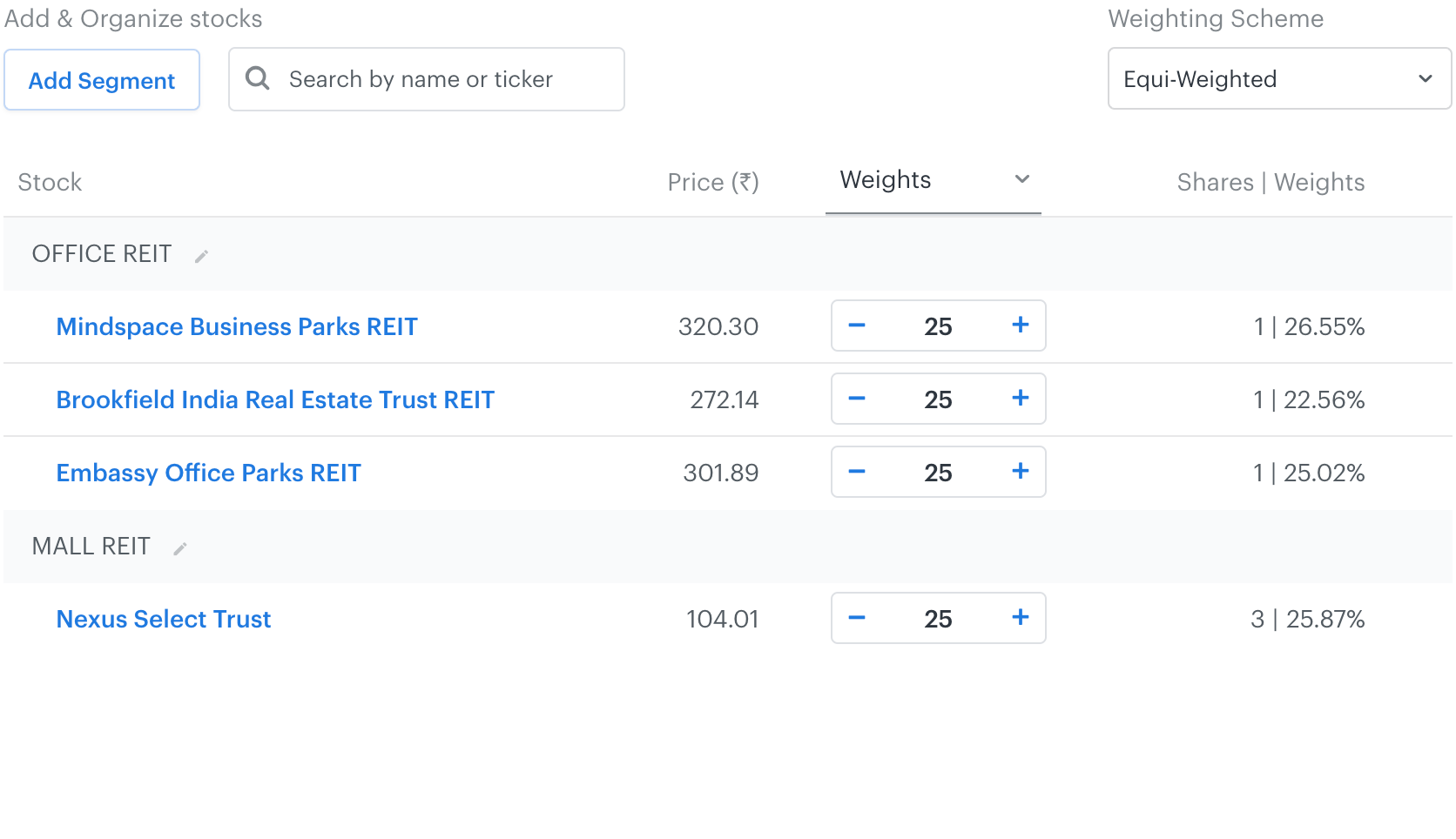

I've created a set of ETF Smallcases which you can create yourself. I'm spilling the beans here, it is a combination of stuff, which you may or may not want to rebalance every 6-12 months.

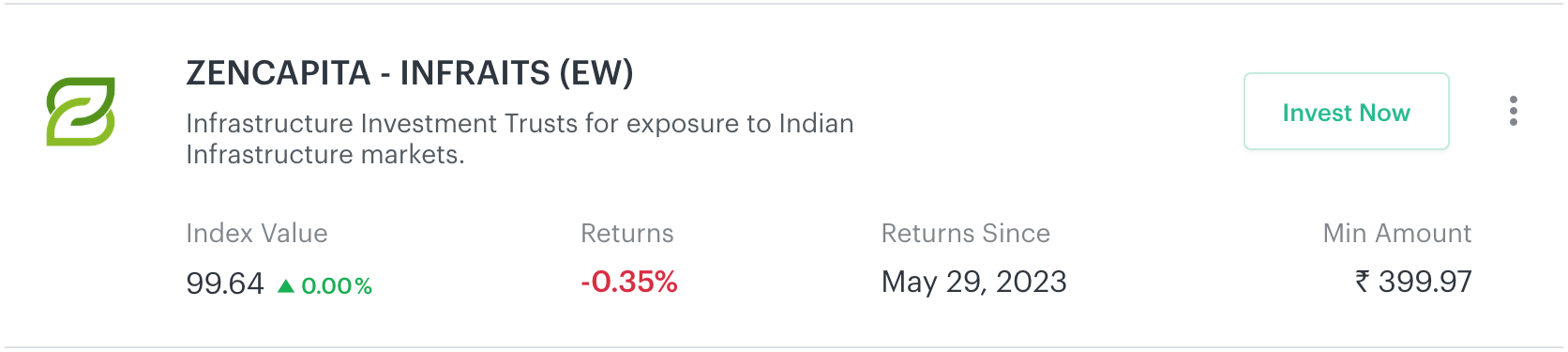

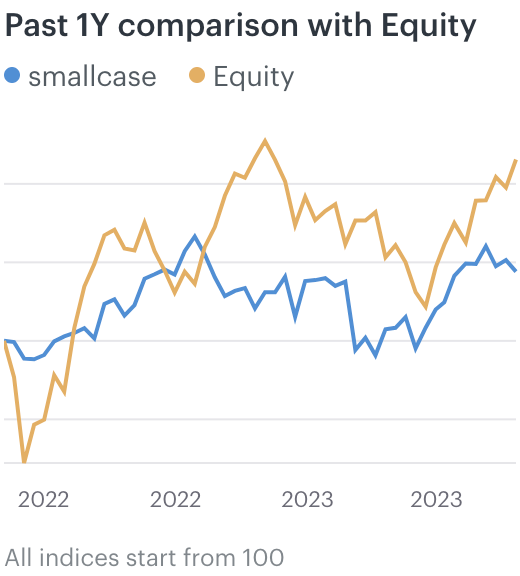

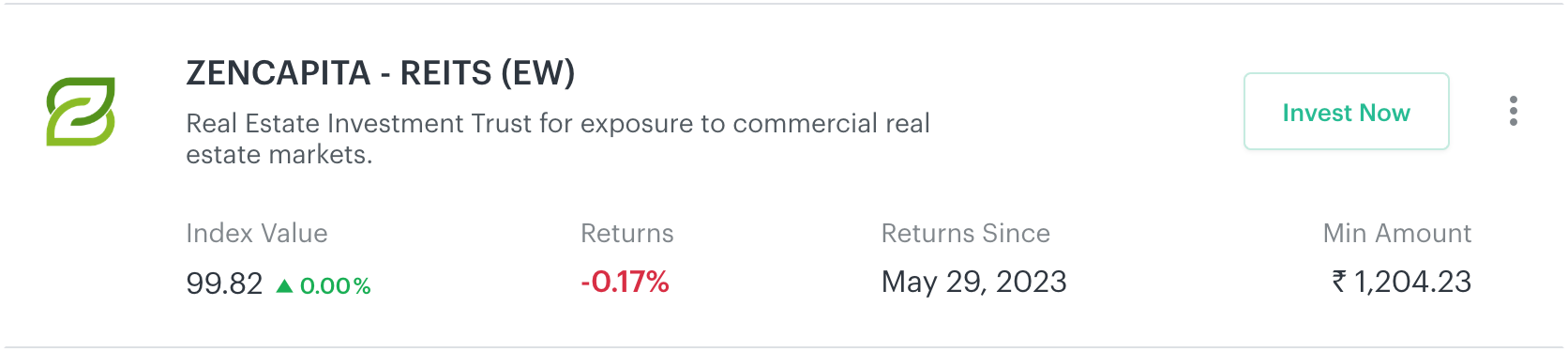

Here are the equally-weighted smallcase baskets, I'll be starting them on 1 June 2023, so that we will remember the date.

So, you see, all you need is to CREATE these in Smallcase, and just type in the names/tickers. Select Equi-Weighted in Weighting Scheme & you're done.

When you invest, you can select the frequency of the SIP, I prefer to stick with weekly, and since we're using Dhan, there is no ₹10 charge per SIP that you do.

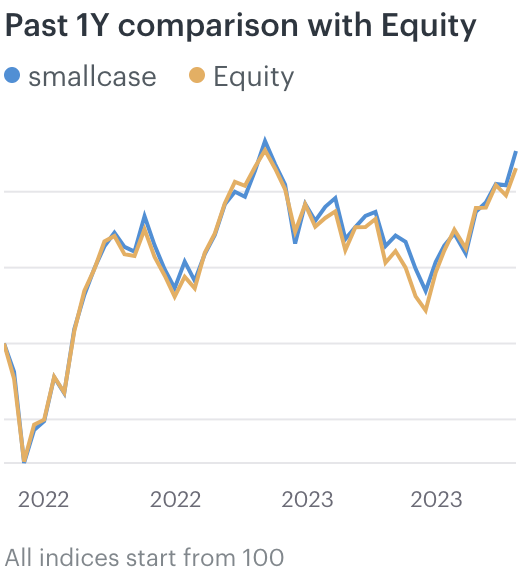

Keep in mind, that for the REITs & INFRAITs, the performance will show lower than the benchmark, because they're paying out distributions.

Save/Bookmark this page for later as you can come back and refer to it when creating your smallcase, or when rebalancing every 6-12 months.

If you haven't joined Dhan, do check it out. I was quite impressed with what they've done over the last year. I hope to see them continuously improve.

Join Dhan (referral / affiliate link, that generates income for us at no extra cost to you)!

To learn more how to Systematic Investment Planning (SIP), read more below:

May your longs go up, and your shorts go down!

Member discussion