Super Seven Smallcase

Every December, I spend time going through my investments, including those made via Smallcase. And review which did well, and which didn't.

Some of these Smallcases are paid, and not free - so you really have to have a justification for paying a fee. Think of it like a management fee that Mutual Fund houses charge. (If you know me by now, you'll know I don't recommend Mutual Funds, here's why).

However, if for example a Smallcase Publisher (they're not called Managers) charges ₹15,000 per year. You need to at least have an investment of ₹5 lakh, to make it worth it. Here's the calculation:

₹15,000/₹5,00,000 = 3%

So technically, your fees should be lower OR your investment amount should be higher to make it in line with the industry average of 1.5%-2.0% i.e. if the fees is ₹15K, you should at least invest – for a 1.5% fee – ₹15,000/0.015 = ₹10L or for a 2% fee benchmark - ₹7.5L

Okay, so I don't like paying fees... (help me increase my return!)

The alternative, is to do some work, and create a Smallcase that you can manage yourself. Which is what we're going to do. The reason why I prefer index funds, via ETFs, is because of the low expense ratio. Second, the information asymmetry that portfolio managers (particularly fund managers) have is slowly diminishing.

The more complicated you make it, the less you will follow the process. So keep it simple, as far as you can.

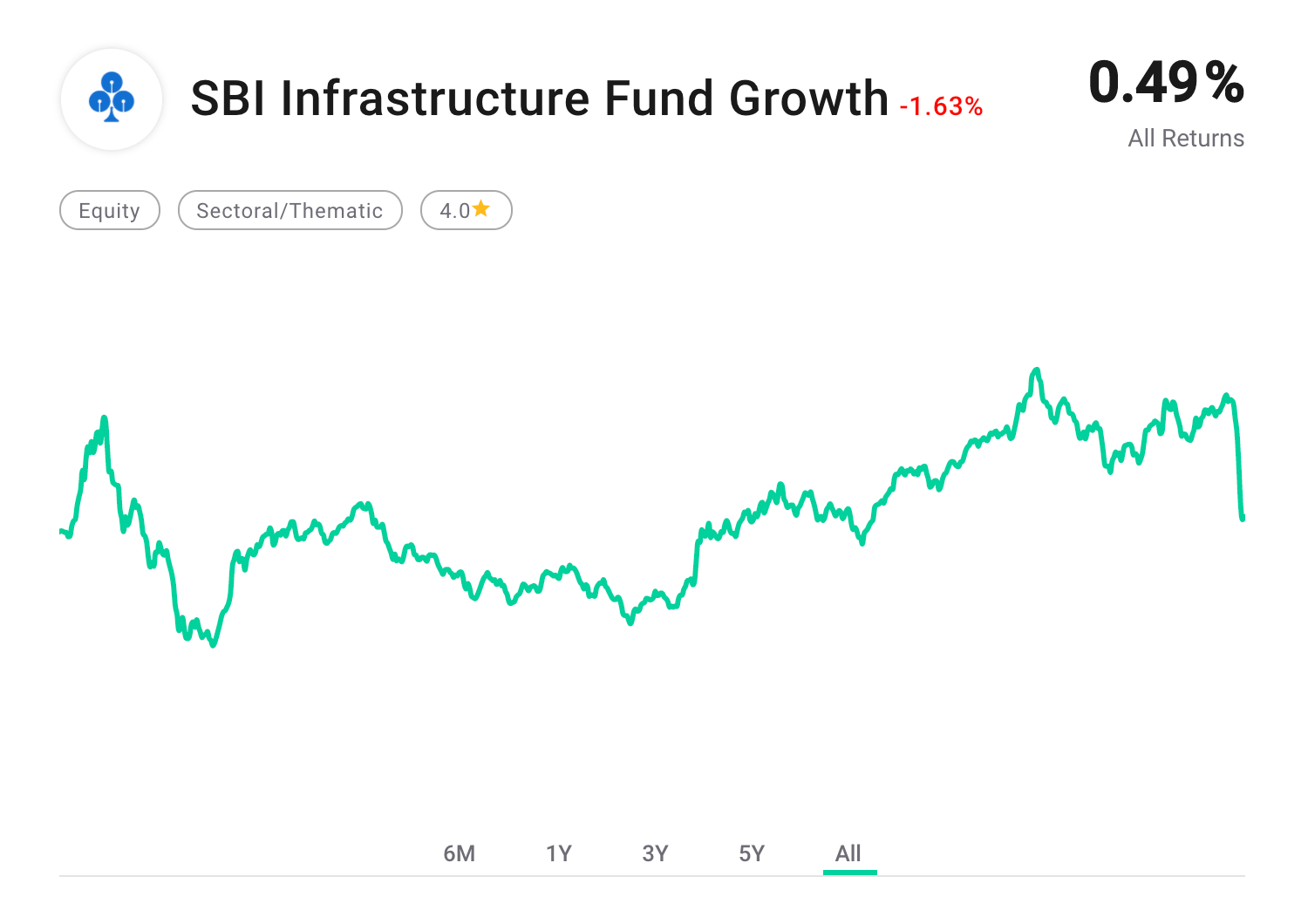

Below you can see the results for the existing Super Seven smallcase portfolio I created (starting 11 April 2022) which has no rebalancing (and ad hoc SIP).