Systematic Investment Plan (SIP)

Timing the market is probably one of the most difficult things to do. If you hear anyone give you a precise number and date, you have identified a liar.

Good traders / investors can probably give you a range, never a precise number for the level the market will go to. But even they cannot give you the precise time, or even a time period for when that range will be reached.

Which is why Systematic Investment Plans or SIPs are the best option to go for. You've probably heard this phrase from someone trying to sell you a mutual fund. Well, that's because it actually works, not just for mutual funds but for stocks also.

An SIP in simple terms is consistently and frequently buying a fixed small / large amount into an investment over a period of time. The amount can be as low as ₹100 or as large as you want.

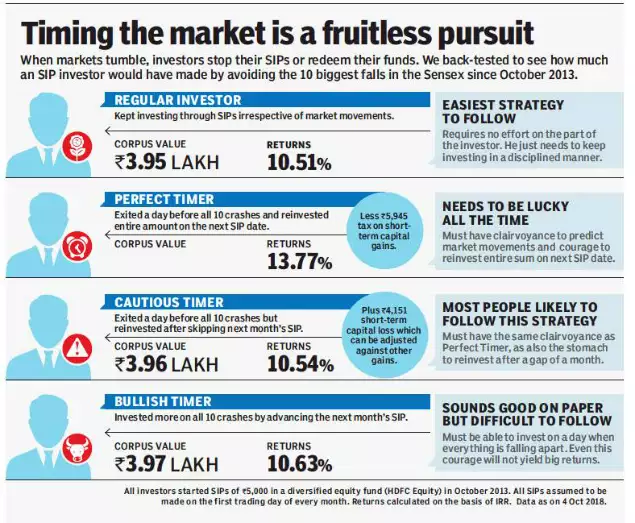

Now, whether it is worth timing the market or not, you can check out this nice infographic, courtesy Time of India - study it carefully:

Long story, short - it doesn't matter, because the marginal increase you get is not worth the effort. So here's what you can draw from this...

Doing an SIP requires discipline, over years, not days or weeks or months.

What I've seen is two extremes, one set of people start investing regularly, only to stop SIP investing as the market reaches all time highs (thinking that the market is peaking) and the second set of people start investing regularly, only to stop SIP investing as the market starts correcting (thinking that the market is going to crash, and its best to start again at the bottom).

If you're in either of those categories, read the above infographic again.

The market consistently reaches all time highs. If you're worried about that, stop investing, and go live your life.

You see, bull markets climb the wall of worry. And just when everyone has missed the move up, they all pile in - only to cry when their portfolio is down later.

Time and again, fear and greed. We see it all the time, it's human behaviour.

Whether the market goes up, or goes down - stick to your plan, stick to your commitment, push through the obstacle as Ryan Holiday would say.

Now that you're convinced SIPs are the way to go, three questions that may pop up in your mind are:

- Which day is the best to do an SIP?

Answer: Thursday, though it won't really matter. I suggest Thursday, because it's an expiry day for futures and options traders, and often positions are cleared by then. - What frequency is the best - daily, weekly, fortnightly, monthly?

Answer: Well, the team at Redwood Research aka Prime Investor took this question up, sliced and diced everything and came to the conclusion - it won't really matter.

They took daily, weekly and monthly program. Fortnightly didn't seem to be part of their analysis, though it is possible through Smallcase.

Well, the difference between weekly and monthly was just 2 - 23 basis points (i.e. 0.02% to 0.23% difference, or let's just say an average of 12 basis points or 0.12%). - Should you SIP or do Lumpsum? (This question should is weird!)

Answer: The longer the investment horizon, the less difference you will see. Generally, over a long period of say 10 years, both SIP & Lumpsum returns will almost be the same.

However, on a shorter duration of 3 years, you'll see a much bigger difference. Which is why, even if you buy at the peak of the market, over a 10 year horizon, your investment could still do well.

In our members area, we discuss how you can put your lumpsum amount to better use. The strategy will give you a light bulb moment, once you understand it, and why we use it ourselves. But this opportunity is only available for a short time, it may not last longer.

If you don't have a lumpsum of money to deploy, don't worry - your best option is to SIP until you do have.

Now I don't think they factored in the extra broker platform cost of doing a weekly SIP – but it seems like monthly is more than sufficient for most. Unless, of course you do large amounts where the brokerage costs become negligible. For example, if you do ₹100 weekly SIPs, and your weekly brokerage is fixed at ₹ 20, then you lose 20% there in transaction costs itself. But if you do ₹10,000 per week - the downside is still negligible (0.2%).

So given the negligible difference, and you want to take the path of moderation - i.e. neither weekly nor monthly, go for a fortnightly SIP, i.e. one every 2 weeks or 15 days. And start your SIP on a Thursday. What is important, is that when you start, you DON'T stop - have discipline.

Many like to time their monthly SIP with their salary day, so they can do it & forget about it, which is fine. This is typical for those in India, as salaries are credited on a monthly basis, typically around the 23rd or 25th.

But if you're a person who comes with irregular income, push for a fortnightly SIP, so that you build discipline and push yourself to generate income - hustle baby!

There is a general consensus is that you get a better return if you invest on the 25th of the month. I assume it's because most will get their salaries on the 23rd, and need a few days for it to show up in their bank account. Good marketing by Mutual Fund companies of course – strike when there is (hot) money in the bank!

The other side of doing monthly SIPs is when dealing with tax filing, especially for Long Term Capital Gains (LTCG). You can easily figure out the ending date (i.e. 12 months) from your date of entry, and the amount invested.

But if you're going to be holding onto securities for longer than 12 months, it doesn't really matter – you won't be selling for a long time.

(And if you're think I'm a buy and hold investor, you're wrong. Please read this or click on the link below.)

Coincidentally, in the US, payrolls are every 14 days (in some states even weekly), instead of every 30 days like in India. I call this the Pavlov Dog Day... pay day will always give you a boost of morale when it comes in fortnightly, thus giving you that extra motivation to keep working hard. Or that's what you'd like to think - motivation is a whole topic for another day.

The only reason you should consider doing a weekly SIP is if you have the savings readily available (sitting idly) in your bank account and have plenty of time on your hand.

Now, assuming you can create an SIP and stick to it.

So should you abandon lump sum investments? The answer is no. Lump sum investments should complement SIP. (If you use Smallcase for stocks, there is the ability to do lump sums in between also).

Here's a tip: when the market does correct by more than 10% and you have funds available, you can increase (sometimes double) your SIP amount, depending on how much cash you have available.

If the market corrects more than 25%, then heck - liquidate any fixed deposits you have, and invest more! (Those who followed this strategy in March 2020, have done well). And if you're doing what we did, you won't worry about any of this (to find out more become a member)

And keep in mind, that SIPs work mostly for volatile investments like equity (even gold), and not necessarily for debt based investments (in those cases, lump sum is the way to go).

Now this '₹upee Cost Averaging' is not easy, as it is like catching a falling knife. I'm only recommending this if you're planning to hold the investment for 10 years (because that is how long it will take for you to reduce the riskiness inherent in the investment).

Always keep some money ready to deploy, what we call keeping the gun powder dry, so you can continue the battle, when (not if) the market corrects. SIPping alone will not help, to really make things work, you have to be opportunistic, and for that you need to have cash ready!

If you haven't seen my video on pyramiding, you should - it teaches just the opposite. And you can't see that by itself, you have to watch the whole series.

Here is the whole series (it's completely free guide that I used to charge $199 for)...

So, without further ado. Please note that investing and trading is risk. Kindly read our disclaimer. Consult your own financial, tax and legal advisor.

Would you like to learn our detailed strategy for building wealth? Have you heard about FIFSIP? 👇🏼

In the meanwhile, if you’d like to chat with me, I’m available on twitter @ zencapita

Member discussion