Market View 20230724

The BankNifty has had a spectacular run up. The question now is will it sustain as we're in blue ocean territory, or will it revert to the moving average below. While we saw this slow movement to the moving average just a week before, it does not mean it will continue. With the monthly expiry, and also key global events before the expiry, we could see a reversal as traders don't like uncertainty.

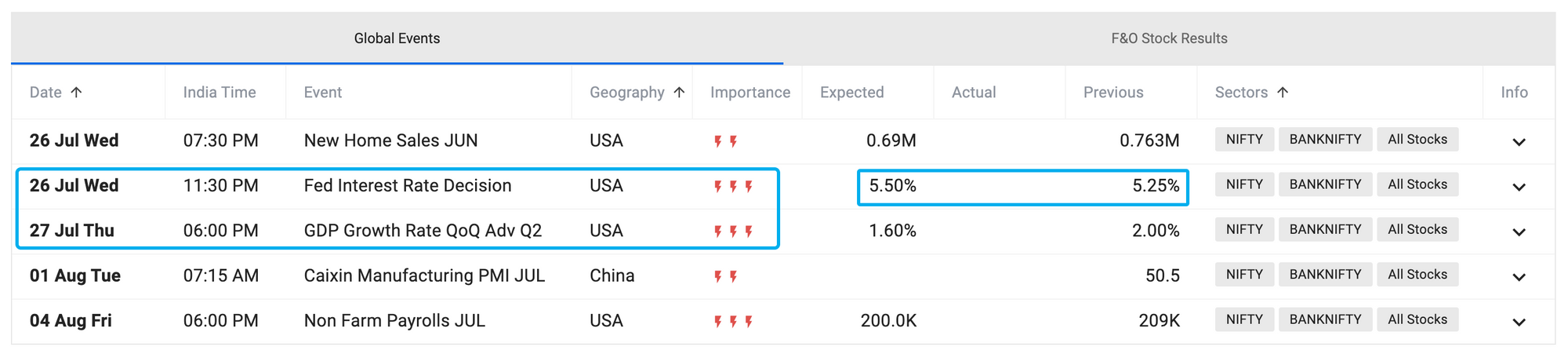

Something to keep an eye on are two significant events that can affect the market, the Fed meeting, and GDP numbers:

934AM

Markets opened flat today, and we have a range of 45900 to 46300 to move within, break any of these levels and the move can be fast to that side. This a tight range, and being a Monday, typically it would have been a move up, and then held for the rest of the day. But this weakness seems like the bulls are exhausted!

Yesterday, I observed the massive volume on NDX (US markets), which was unusually high, marking the reversal of a trend.

322PM

It's been a slow drift downwards, still holding the 45988 level. Let's see if it will close below that point.

The market is holding up well, this may continue until Thursday expiry. After which we start the next series for August. Next 3 days is going to be interesting.

0339pm

So we're still holding high right now. Small weakness, but not enough to see downward movement. There is however a gap to be filled below at 44000 level.

Member discussion