Market View 20230904

For this week, I'll wait to see if the BankNifty retreats below the trendline, confirming the downward trend, or whether it will move sideways as part of a further consolidation around 44000 and 45000 levels.

9:52 AM

Looks like a gap down, and then a 700 point move up in the first tick of the candle. This could indicate a range for a breakout / breakdown. But the fact that it opened below the trendline is probably an indication of what is to come...

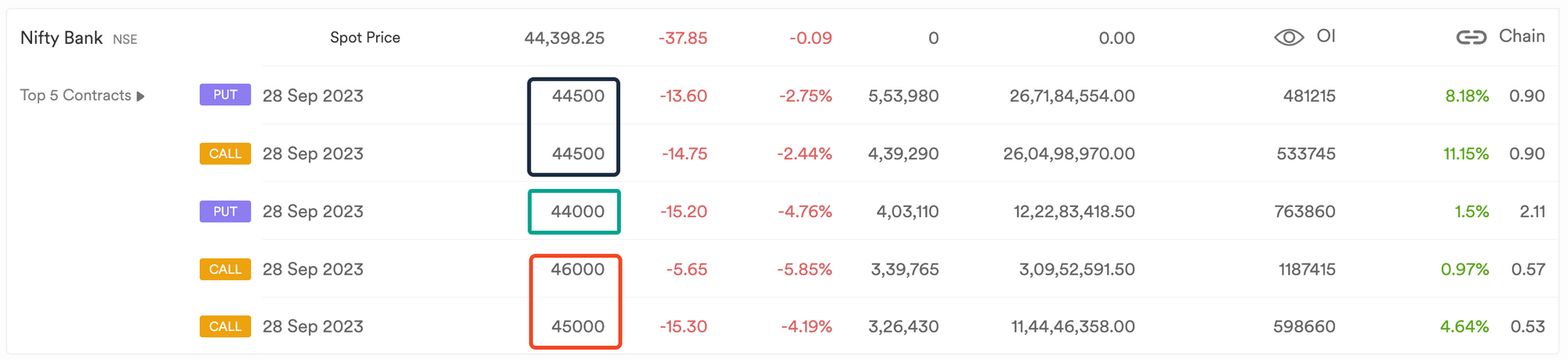

A look at the September series, we notice a 44500 straddle formation, with a support at 44000 and resistance at 45000/46000. So we can safely say that the range is 44000 <>45000.

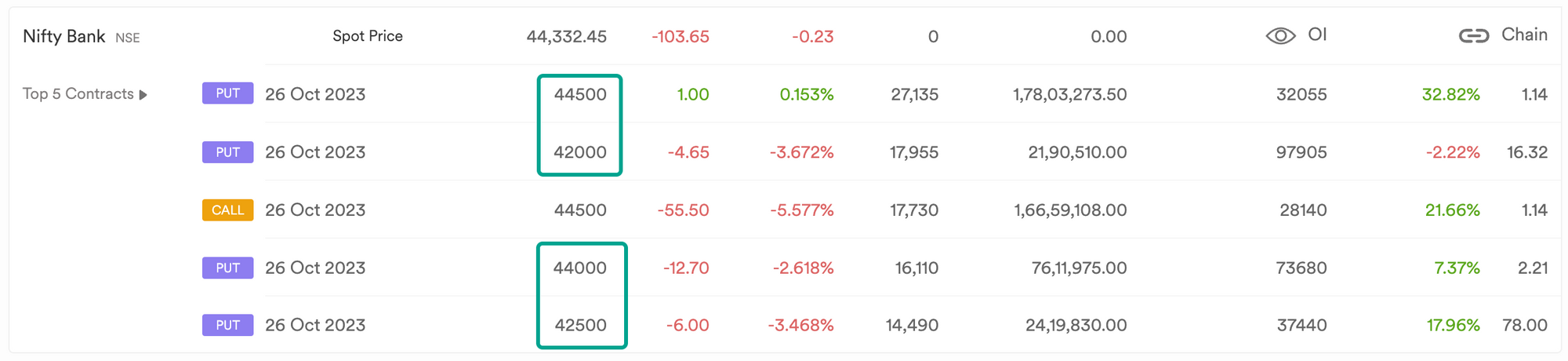

A glance at the October series, the picture looks more bullish, with plenty of puts starting from 42000/42500/44000/44500 and with the 44500CE being the only resistance level.

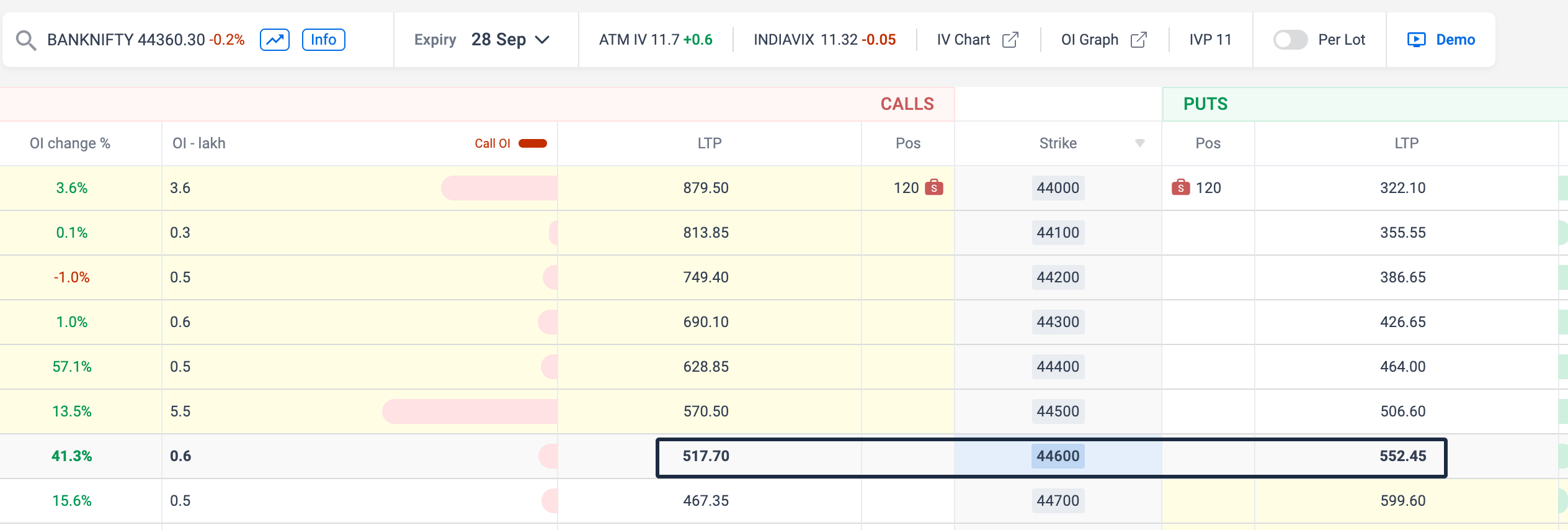

If we use the premiums of September monthly options as a proxy, we have a range of 43500 <> 45600.

So, if I combine the two, I'd say we have 44000 as a strong support, with a bullish upside and resistance at 45000.

Member discussion