Market View 20230920

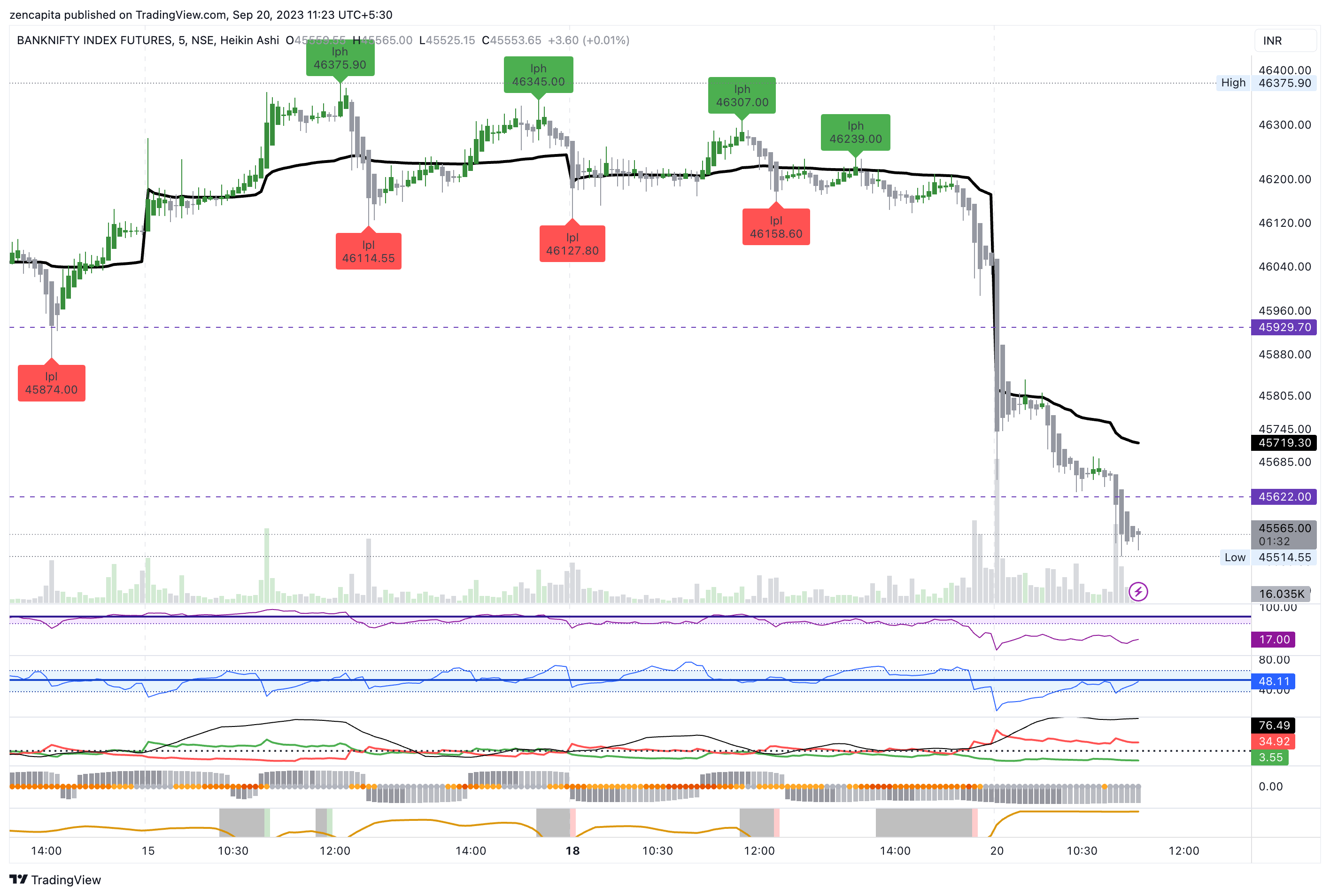

The market opened with a gap down. And this was when everyone was expecting the market to move higher. Euphoria is a thing you have to keep an eye on.

Today being an expiry, makes it more dangerous for those who have gone long, as they will try to unwind, as they book losses. They may hold on for some time, or you could see a dump at the end of the day.

This is what we call, up the elevator and down the lift. We're moving down the lift now. How low will this go, today being an expiry I don't want to venture a 1000 point drop, but nothing is impossible these days.

The diplomatic tension between India and Canada have increased. I never thought in my wildest imagination that this would be a situation. But it is.

Anyways, we move with the market. we have crossed a major Resistance/Support Zone and we have the 21 moving average at 45280, so expecting some settling around there. If that breaks, then its going to be a bit more nastier.

After a flat consolidating the day before, I was expecting some sort of drastic move, that has happened.

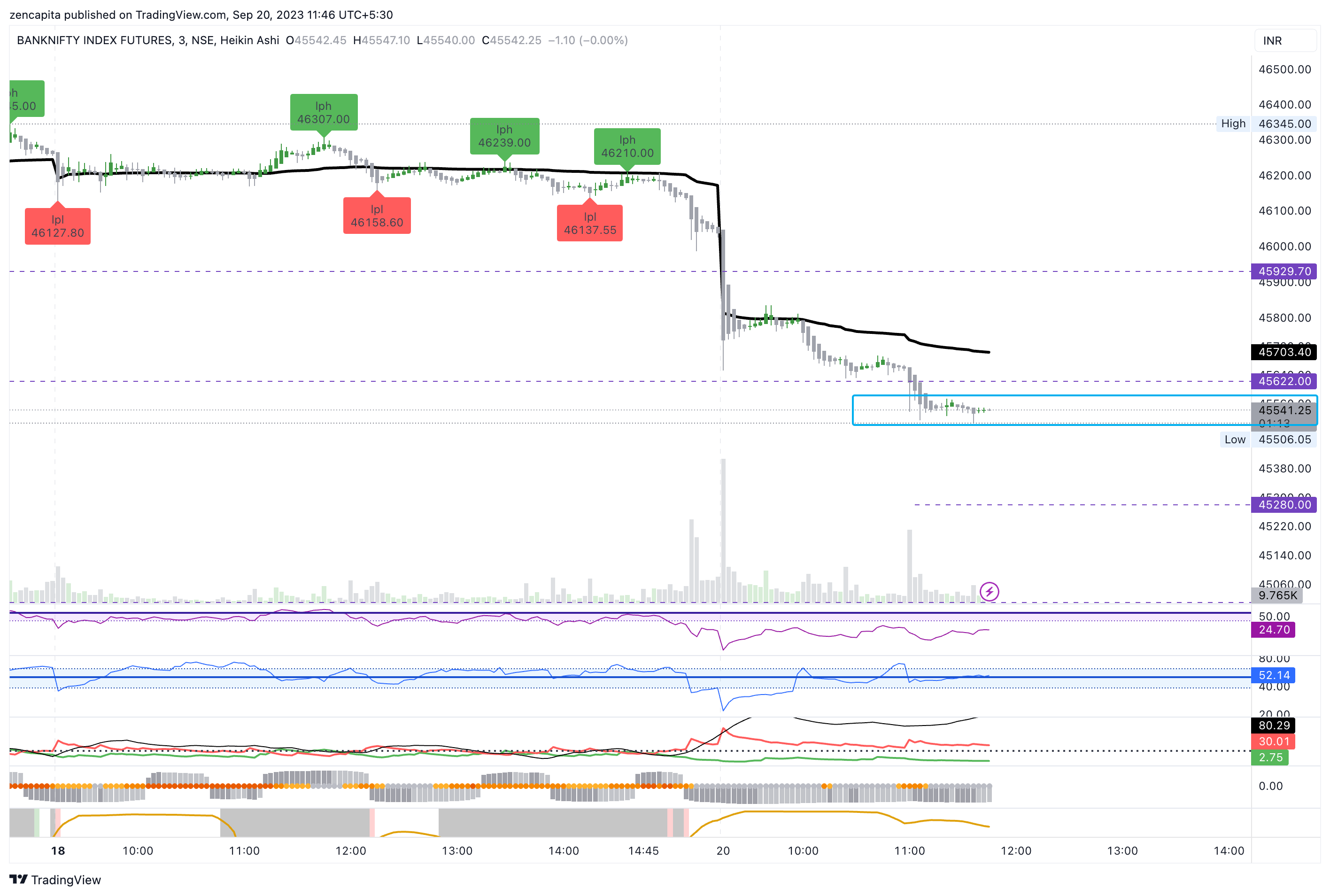

11:47 AM

It looks like a consolidation is happening around 45500 level. If this holds for the day, we could close here, to either resume a fall or see a rise tomorrow. But keep in mind our support at the moving average around 45200-45300 level. The BN is already down by 1.2%, to see it go lower would be a 1.5% drop. Let's wait till post 130 session.

We have the following support/resistance levels. We're quite close to the 45575 level which is where we're hovering around now. If this doesn't hold, then expect lower levels.

3:32 PM

And the markets end just on the zone, 10 points above 45,575!

Member discussion