Market View 20230802

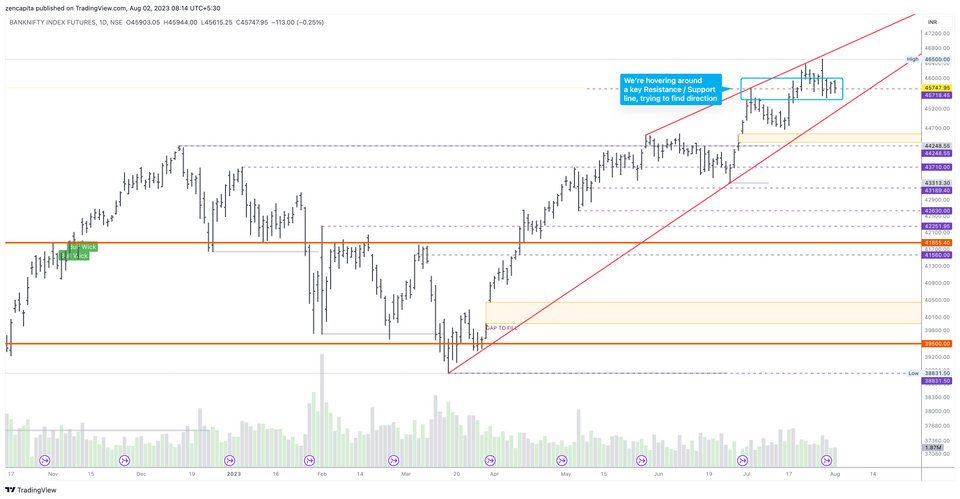

We're hovering around a key support / resistance line of 45700. It may take a while to find direction on the BN. I'm bearish, as we have two gap fills below.

What worries me, is that since we're quite high up, that's a big fall of around 3% and 13% to fill those two gaps. If those gaps were filled earlier, I would have been very bullish on the Indian markets, so for now it's just caution.

However, as mentioned in an earlier post, those fills may not happen for a long time! So until then, we can continue with some amount of confidence to sell PEs.

Another news/rumor that I've been hearing is about the Japanese Bond markets. Some changes that may cause global markets to move in a big way. Until now the Japanese did not suffer from inflation, their government never raised their bond prices. Now, I hear they are planning to because they are seeing inflation!

That's like after a few decades, so who ever is leveraged (i.e. taken on easy debt), is going to deleverage very fast.

10:57 AM

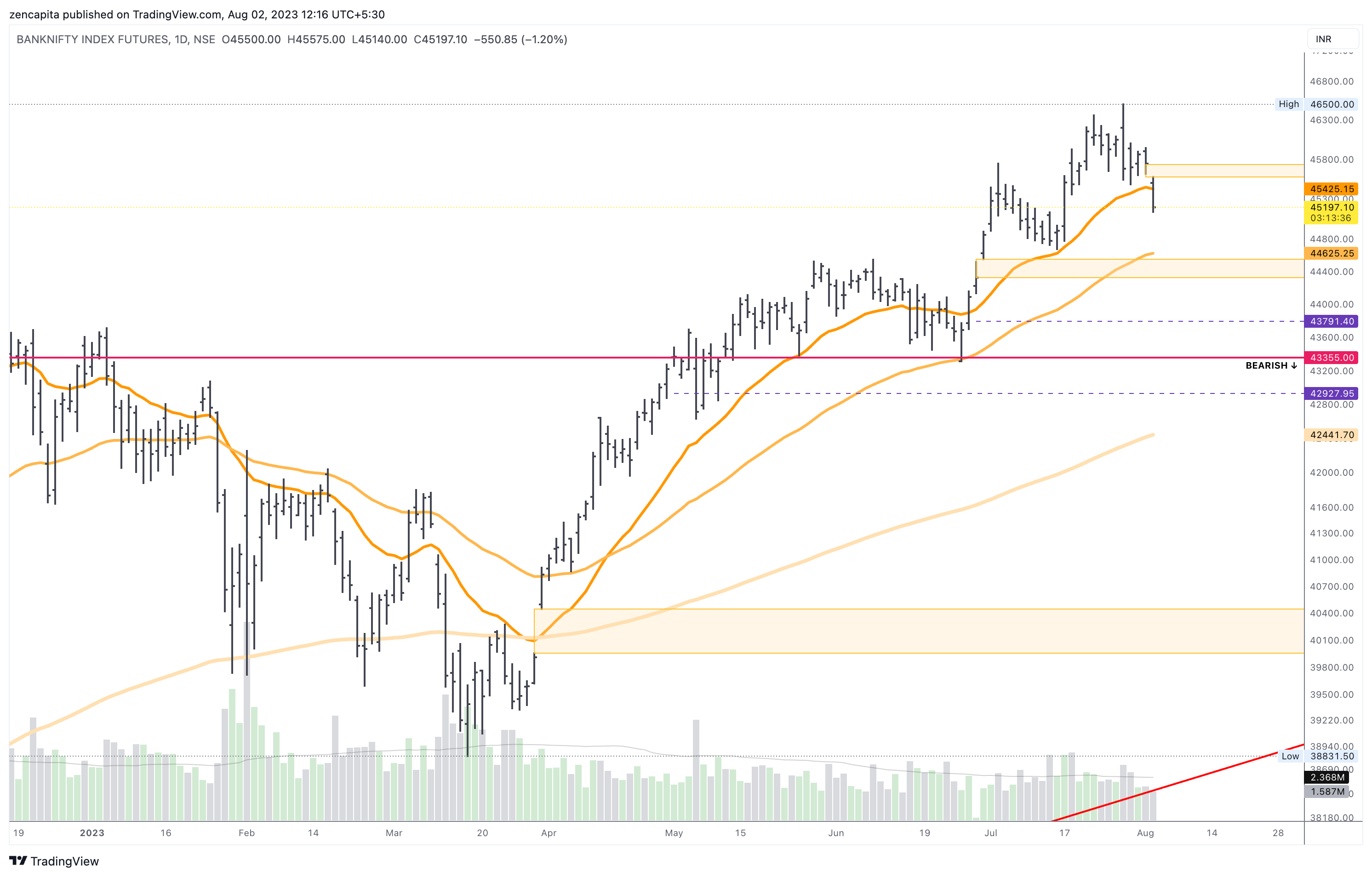

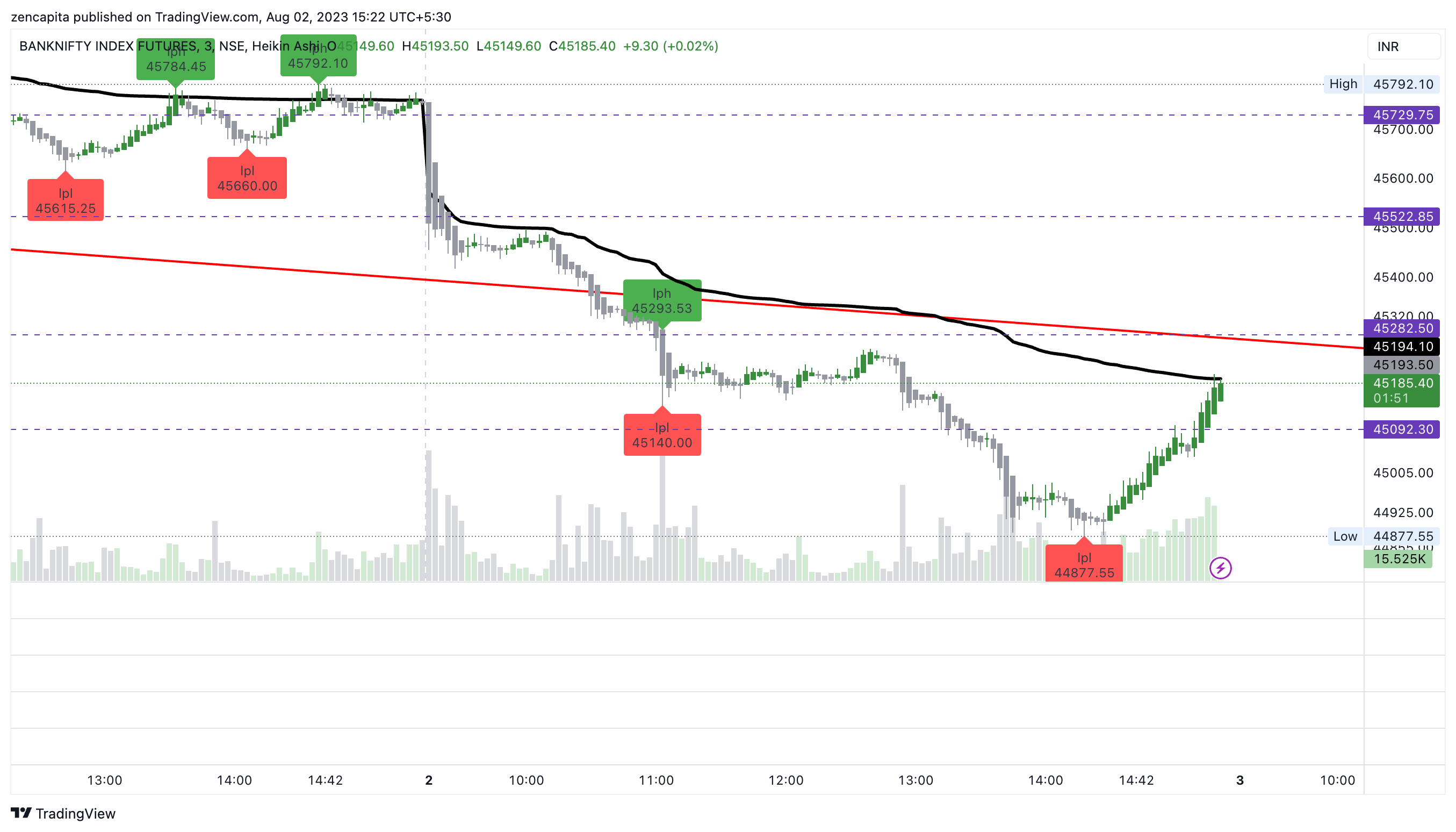

We have finally entered into the trend line, if this breaks, we can see a downward trend, if it holds, we could go sideways for a long time.

11:05 AM

We've also found the bottom of a bigger trend line that started in March of this year. Let's see if we will reach 44000 level.

12:17 PM

BN has finally broken the 21 EMA, will it hold at the 55 EMA (around 44600)?

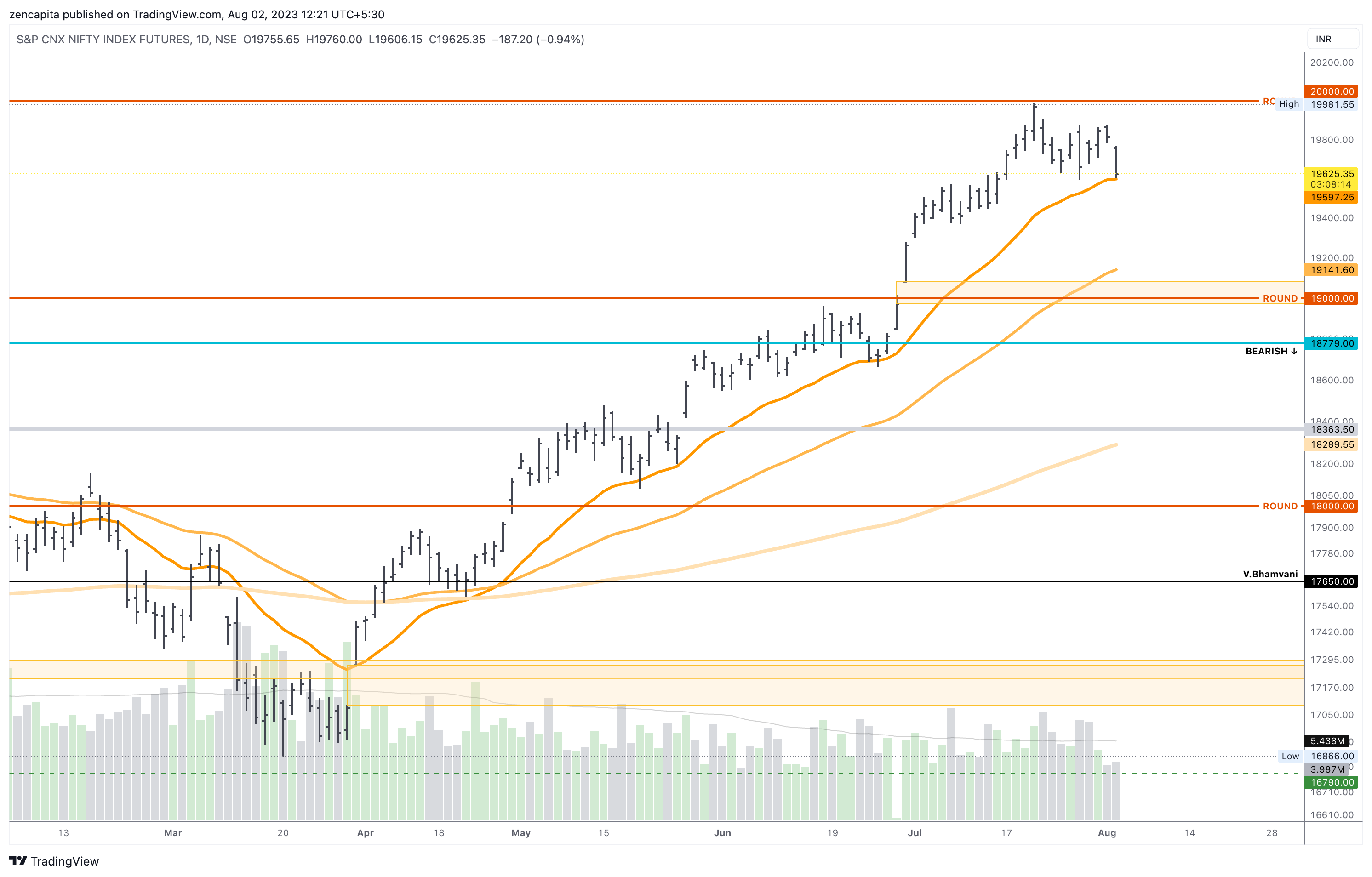

NF is also at 21 moving average, resting there. We will have to see if that breaks also. There is a gap fill on nifty around 19000 level as well.

12:42 PM

Well, there's some more interesting news out today:

Fitch downgraded the US sovereign rating from AAA to AA+, with a stable outlook.

Keep in mind, that

1:47 PM

That was fast! 800 points down.

2:07 PM

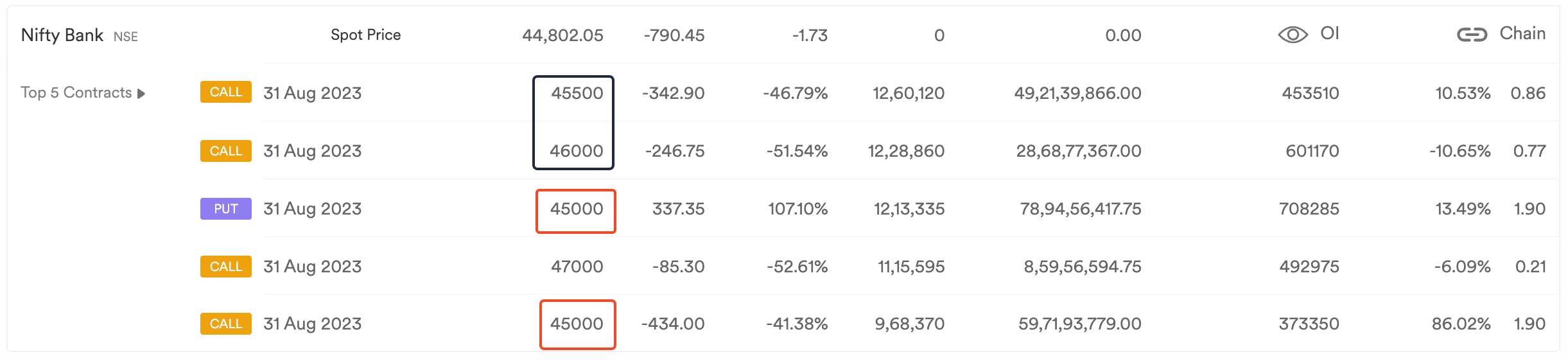

Let's have a look at the options volume.

Seems like we have 45000 straddle, followed by 45,500 & 46,000 CE.

3:22 PM

Volatile day, 325 points up from the low of the day! I don't see it staying above the trendline, if it does, trend reversal, if it doesn't, downwards we go.

So not only did we break the trendline down on the short term, we also broke the longer term trendline upwards.

Member discussion