Market View 20230808

We're forming a nice tight wedge on the BN, in anticipation of the RBI announcement which so happens to be on the expiry Thursday, they couldn't have picked a better date!

2:05 PM

We have been above the downward trendline, and within a box... this may continue until Thursday expiry. After which we may see a big move. We'll try to assess which direction through the option volume.

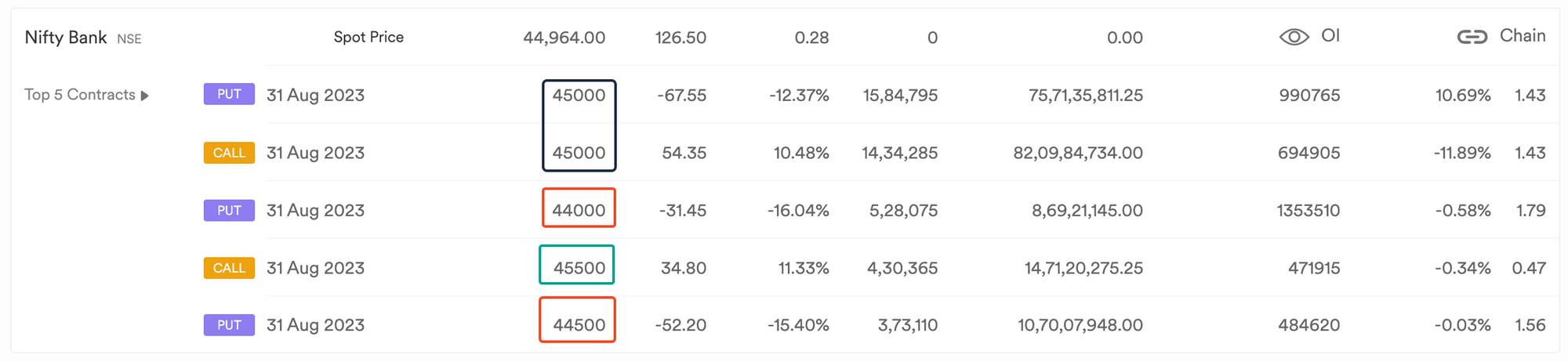

Based on the above, we have a strong straddle still at 45000 level, with support at 44000/44500 <> and resistance at 45500. So that's like a 500 points away from both sides of the straddle. More like an iron fly!

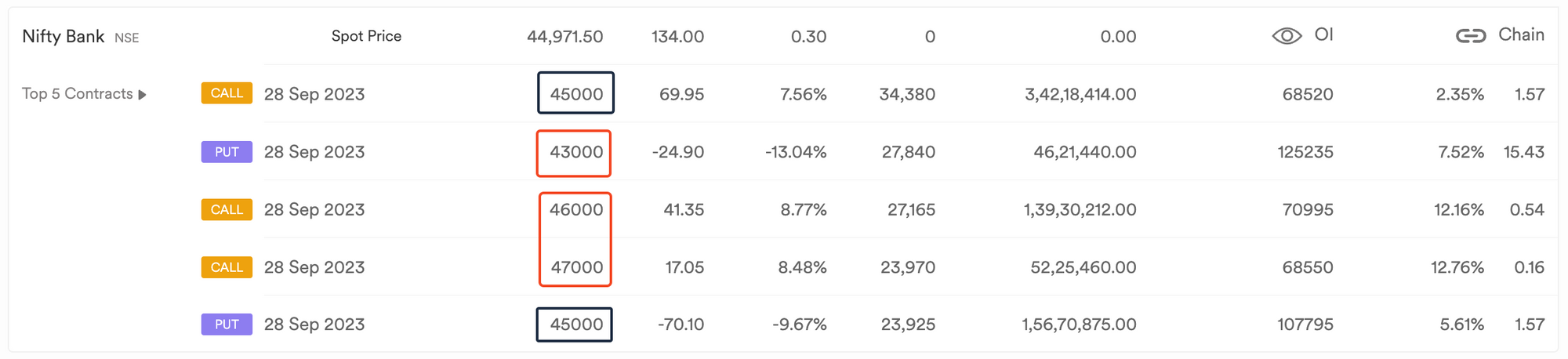

Let's take a month further, and look at September.

Although a 45000 can be seen volume wise, the skew is to the downside, with 45000 being the highest volume. And 46000 at the higher end, and 43000 at the lower end: 43000 < 45000 > 46000.

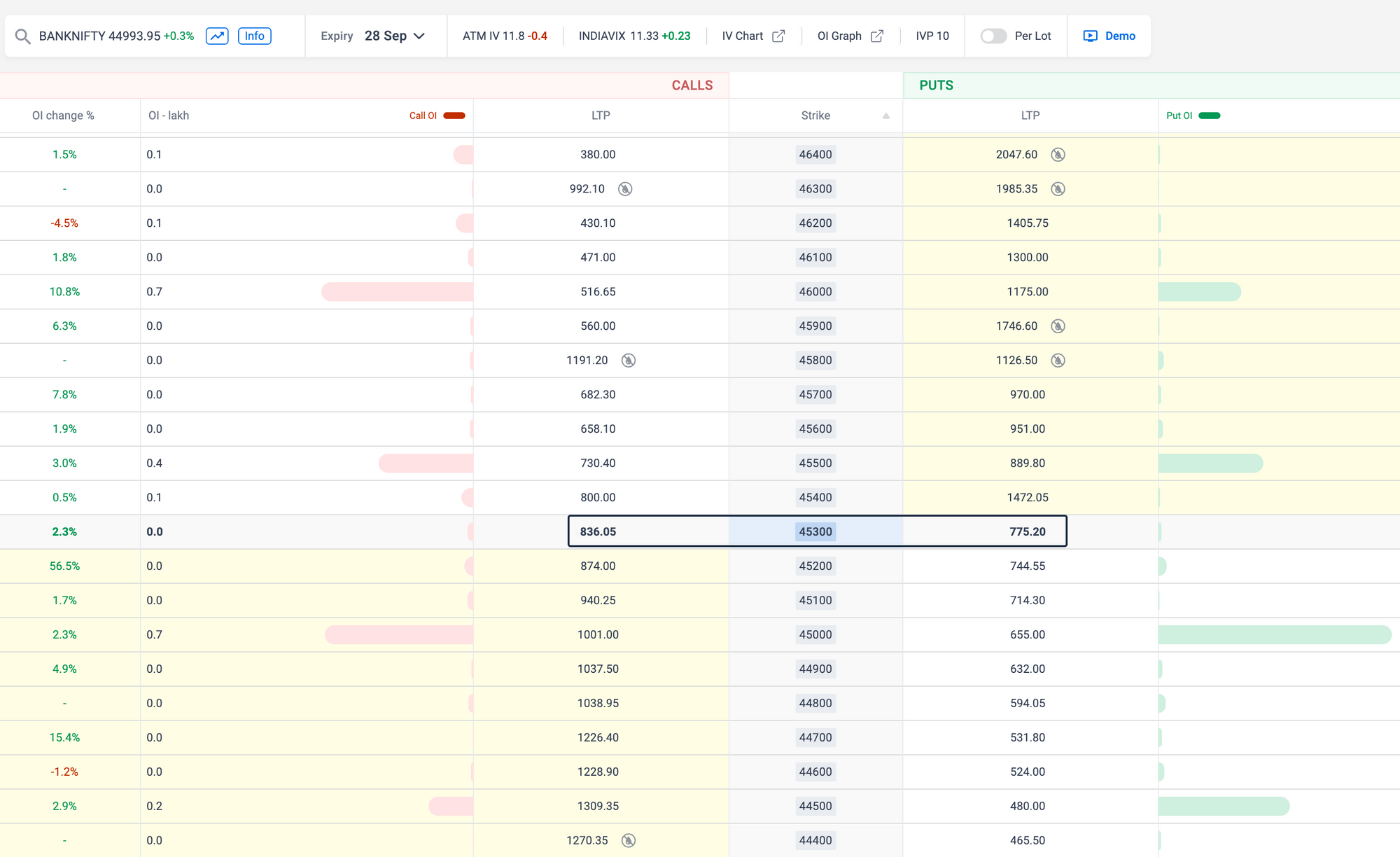

45300+/-1611 leaves us with a range of (43689) 43700 <> 47000 (46911) for September.

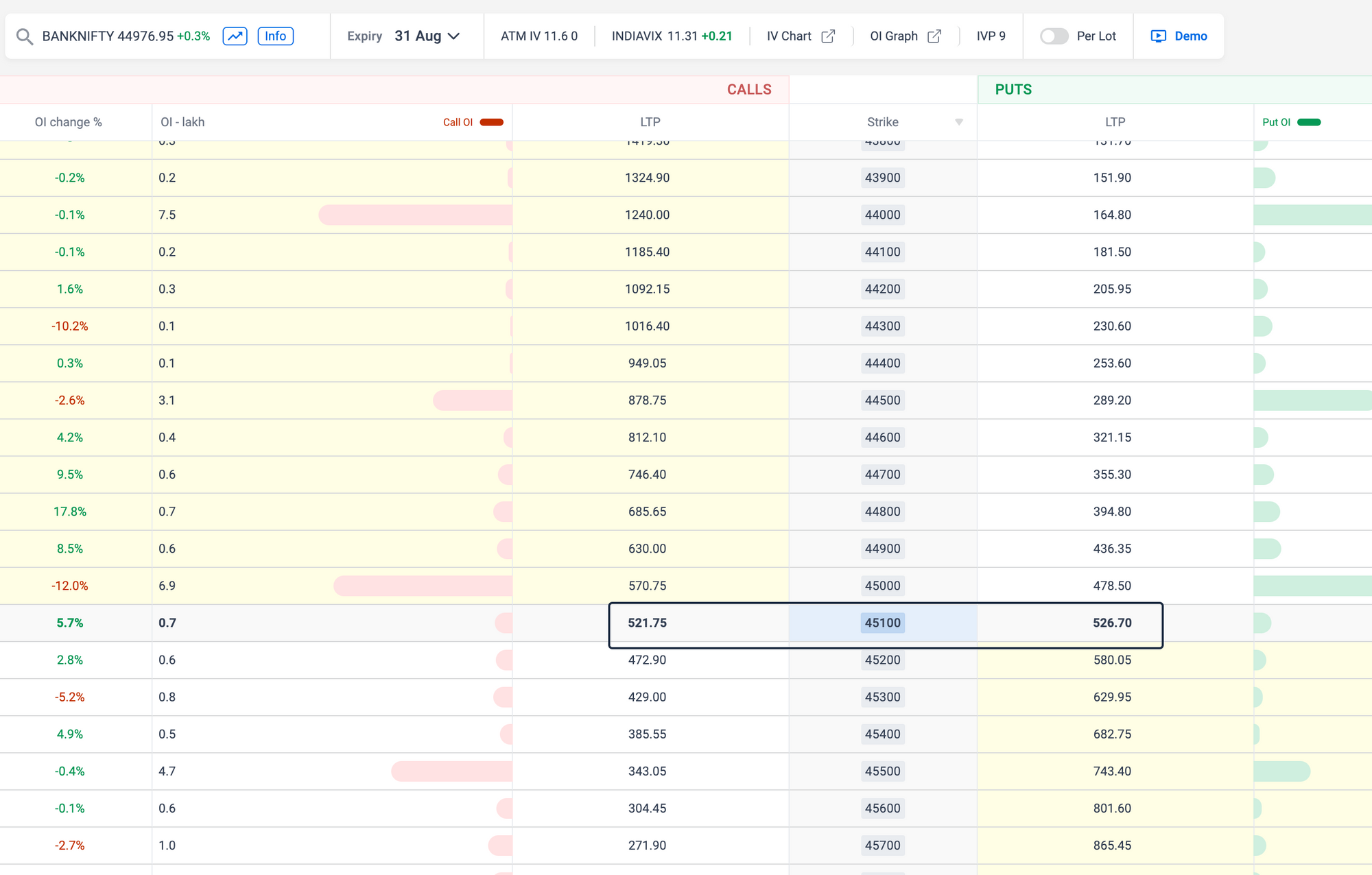

45100+/-1046 leaves us with a range of (44054) 44000 <> 46100 (46146) for August.

Member discussion