Market View 20230721

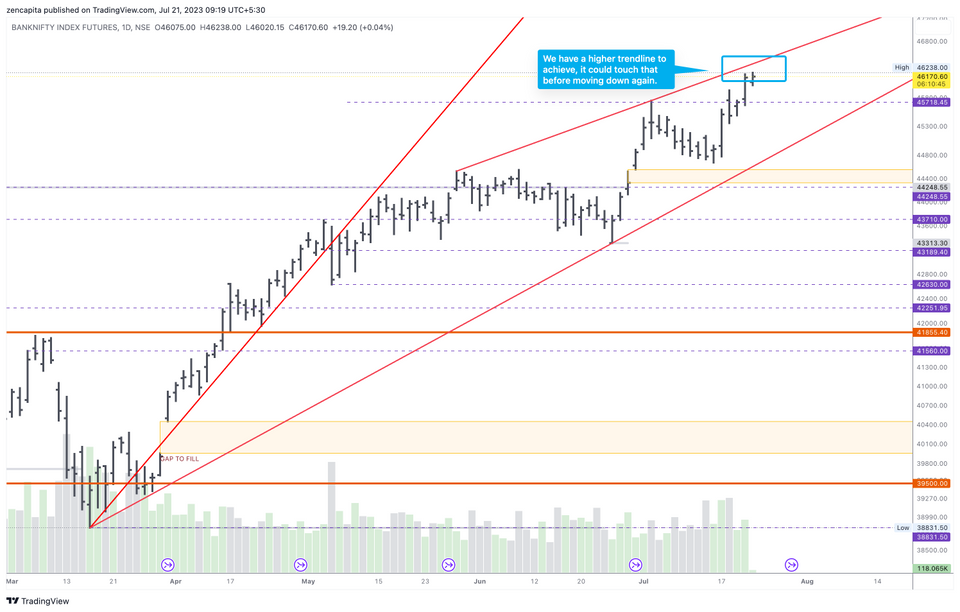

Following the run up, I had to redraw the trend lines to see if that's what other technical analysts are looking at. And by the looks of it, yes... could see a touch at higher levels before correcting. Otherwise, if the market is exhausted from the run up, we could see that happening within this week.

There were a couple of results that came out and are coming out, that have helped in this move. One is ICICI Bank, but this stock is known for its wild swings.

Never short the Indian market is becoming a true saying.

Today, while the BN is scaling new ATH, the NF is not showing that strength.

And there we go, we touched the trendline... now we can resume normal movement!!

I thought I'd talk about Gap Fills, these are those yellow boxes that I mark on my charts.

Gap Fill is not a precise art, but it does have an uncanny habit of getting filled (mostly due to these algo trades).

BUT it may take a long time.

Look at #TCS (weekly chart) for e.g. since October 2020 it has not been filled... but then again, the stock has been going sideways.

The perfect move, would be for TCS to fall to that level, fill the gap, and then start a meteoric rise.

1149AM

We're below the VWAP trend line, if we break 46000 level, it's bearish.

223PM

We have perfectly touched the trendline and hovering now...

We basically touched the 46000 mark before recovering, that's an indication of some support at that level. But can it hold... usually around 230 when the global markets start waking up, we see the trend unfold.

245PM

Just taking a step back, in the last one year, the BankNifty has moved up 40%!

Member discussion