Motilal Oswal S&P 500 Index Fund - Should You Invest?

If you're probably wondering why I left this post to the last minute, it's because to make a decision you only need 2 minutes! Once done, it's done - then you course correct.

Should you invest? If you have the cash, yes. Read on to learn why I feel this might be a good investment, but not as an NFO.

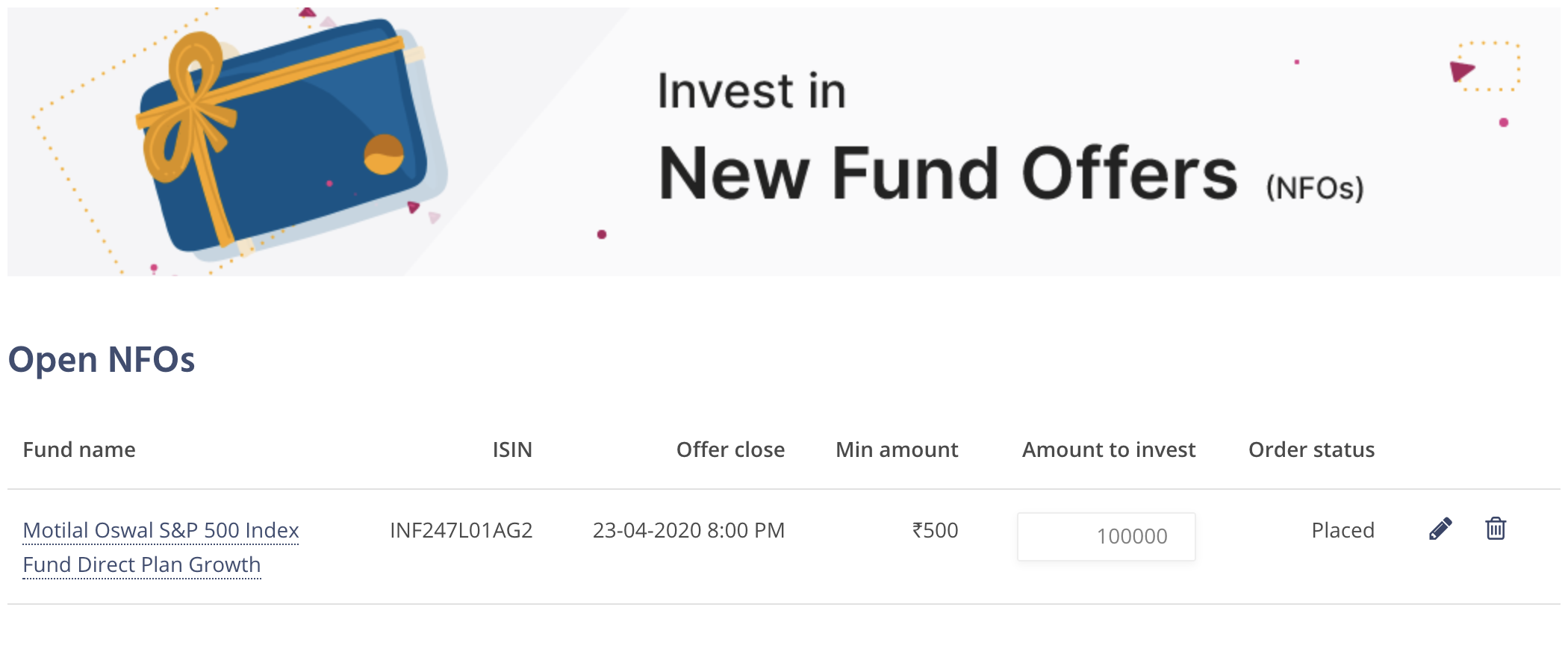

The last date for applying for this NFO (New Fund Offer) is tomorrow - 23 April, 2020 (to be more precise by 8 pm). The minimum investment size is ₹ 500 & multiples of ₹ 1 thereof. Expense Ratio is 0.5% for direct plans, and 1.0% for regular plans – go for direct plan, so you can save that valuable 0.5% every year (which is still high and ruins your returns as you continue to hold).

You can do lump sum, or SIP (which is probably best if you're risk averse) of the minimum ₹ 500 for 12 months. Don't worry about the exit load of 1% within 3 months because you should be holding longer than a year as a smart investor.

This is considered MEDIUM-HIGH Risk investment (in my opinion), so allocate not more than 1% of your liquid net worth. As of now, while the S&P 500 does provide a good dividend yield - I understand this is a growth fund, so there will be not dividend payouts.

I also understand from a taxation point of view, international mutual funds will be treated as debt funds - applying slab rates for holding periods up to 3 years & 20% with indexation benefit for longer - but check with your tax accountant on this, because tax is the silent killer of your wealth.

It's not clear what the tracking error of this fund is (so pls check before investing) which is strange being a passive fund.

To give you a bit of background. The US markets have three indices:

- Dow Jones Industrial Average - usually the index of choice for International institutional investors.

- S&P 500 - the index of choice for US institutional investors, as it comprises 80%+ of US market.

- Nasdaq - the index of choice for US retail investors.

We're talking about the S&P 500, which contains stocks of 500 leading companies in the US, some of the famous ones are Apple, Amazon, Berkshire Hathaway, Facebook, Alphabet (aka Google), Coca-Cola, McDonalds, Starbucks, Nike, Johnson & Johnson, JPMorgan, Microsoft and P&G to name a few. You're probably familiar with these companies. This index has a 60+ year (95 year if you consider the original index of 90 stocks) track record, and consists of a good number of bluechip companies, covering 11 sectors, the largest weight being tech companies (about 25%), followed by healthcare (15%) & financials (10%).

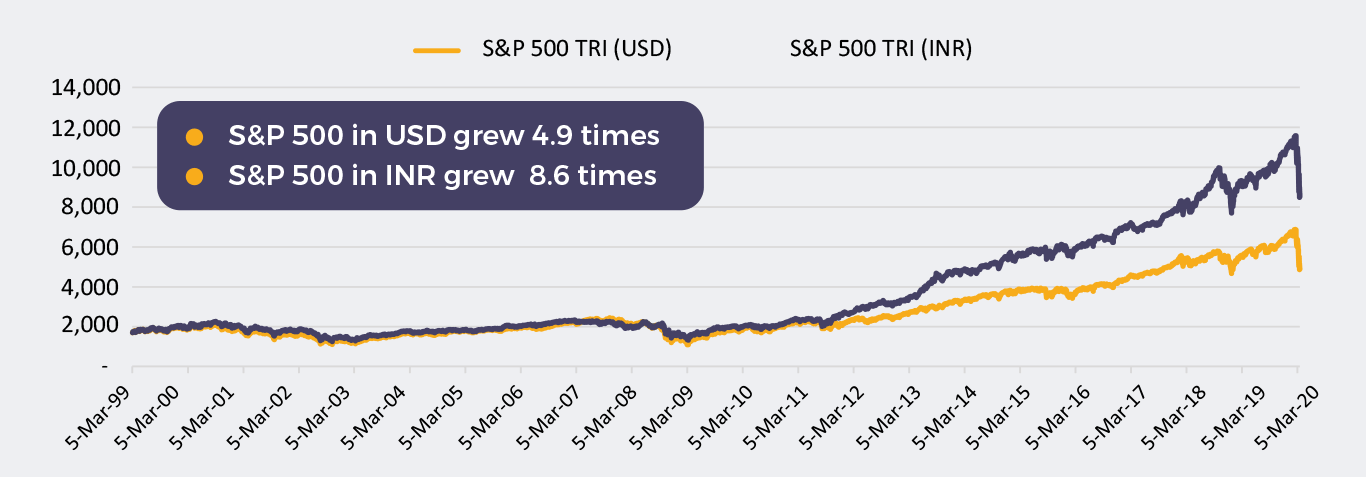

The average return (including dividends) of the S&P 500 is about 11.5% on a CAGR basis since 1948 (i.e. about 70 years) or 7.75% without including dividends.

One of the reasons you would want to invest in this, is to have a US$ exposure. My bet is that US$ will gain strength (as the Indian Rupee could weaken) in short-medium term (1-2 years). There are a number of reasons why investors keep the US$ as a world reserve currency i.e. safe haven. When things go bad, people switch to US$. And unlike other countries, the US has never cancelled its currency. Europe is going through some turmoil, so don't be surprised if investors are switching from EURO to USD. In short, Rupee depreciation will be good after you invest! This will switch on a tube light for NRIs :)

Having said that, yes.. there is still a currency risk when you convert at this point in time from INR to USD. For this reason, some may actually not invest. (Though Motilal Oswal is selling this as though this is going to cover your foreign currency needs like children's education, talk about emotional blackmail!)

Does this provide diversification. Well, from what I've seen - although fund managers are saying there is very little correlation (i.e. the markets are independent from the US markets, what I've seen is that the US markets, particularly the future market is a lead to the Indian markets) - so I don't buy that story.

Now, I don't know much about the fund manager per se. But Motilal Oswal (aka Motilal Oswal Asset Management Company) I understand has a good reputation in the market, both in terms of brand and returns for investors.

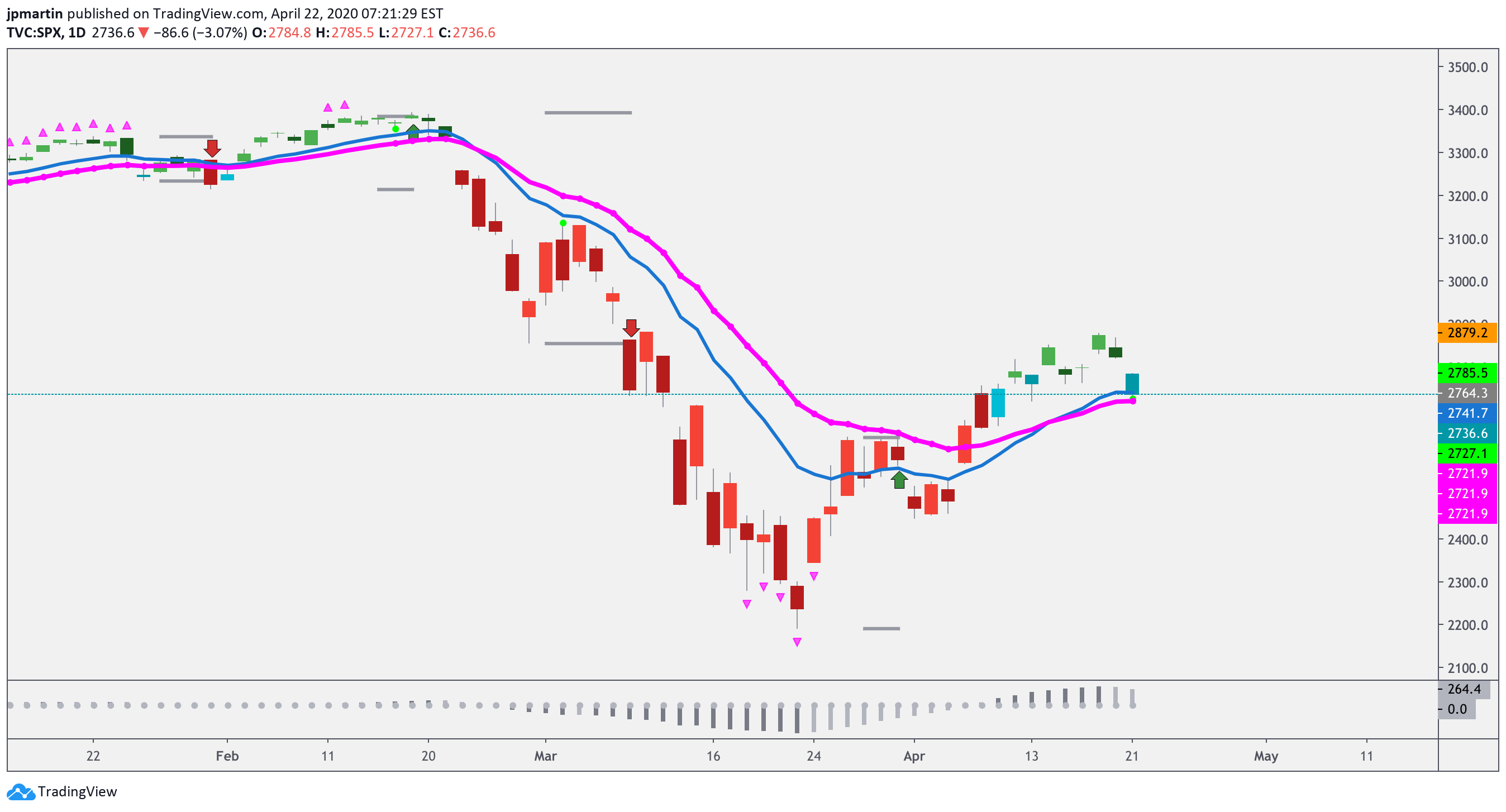

You need to ask yourself the question - whether this is a good time to invest. Well, in hindsight everything is always clear. We'll have PRE-COVID19 and POST-COVID19 discussions later on. But check the chart below...

My personal thought is that the timing is a bit off, for the NFO - yes, the markets may have corrected but will the correction be over when the fund officially trades? Buying into an NFO now, you run that risk that it could go down after you've invested.

From the bottom on 23 March 2020, we've seen a 29% rise already to the date when this NFO offer was launched. So whether we go up from here, or even lower than the 23 March bottom - that will dictate the performance of this fund, and more importantly your returns. This is why SIPs might be a better option, so there's no hurry to invest during the NFO period.

There are 3 types of shapes being discussed for the market recovery. V-shaped recovery, U-shaped recovery and the last which seems to the possible scenario - L-shaped recovery. I believe we'll see an L-shaped recovery in some sectors, while others will experience a U-shaped one.

Keep in mind, that India only contributes just about 3% to the world GDP. The remaining 97% is international, so having an exposure to international companies will pay off in the long term. (It's for this same reason that I still trade in the US).

Now, while buying an index fund is far better than buying an actively managed one - there's also an alternative which many might not know. You can open a brokerage account with either Interactive Brokers or TD Ameritrade, and just buy the ETF - SPY or SPX. This avoids having to pay the 1% every year to a fund manager (which adds up in 10 years). It is a process, but a one time one, and the good thing is you can trade stocks & options as well!

Have I invested? Well, if you're a Jack Bogle or open-ended index fund fan - then the answer is YES - I placed ₹ 1 lakh as a lump sum for the NFO. And will wait till this starts trading on the exchange before deciding to add-on or start an SIP.

My reason for investing is to become a human guinea pig for you. For while I believe this is a good way to get exposure to international companies, I'm not sure this is the best way (see brokerage option above) given the expense ratio and so called taxation benefits.

Plus you can see why I believe buy & hold strategies do not work, especially for mutual funds. Will this be another experiment to write about, time will tell.

If you'd like to see how I'm putting my money where my mouth is and why I prefer to invest directly rather than through mutual funds, please consider signing up as a member.

To see the update on this investment, check out the following post:

Member discussion