Super Seven Smallcase (Update 1)

So, if you've read the last post on Super Seven Smallcase, then it's time for execution. Since this is an invest-in-public post, you'll get to see the good, bad, and even ugly parts of investing. (If you haven't become a free subscriber, please do!)

Whether you want to go along, and create the same is up to you, do so at your own risk - or as the usual disclaimer says, talk to your financial & tax advisor.

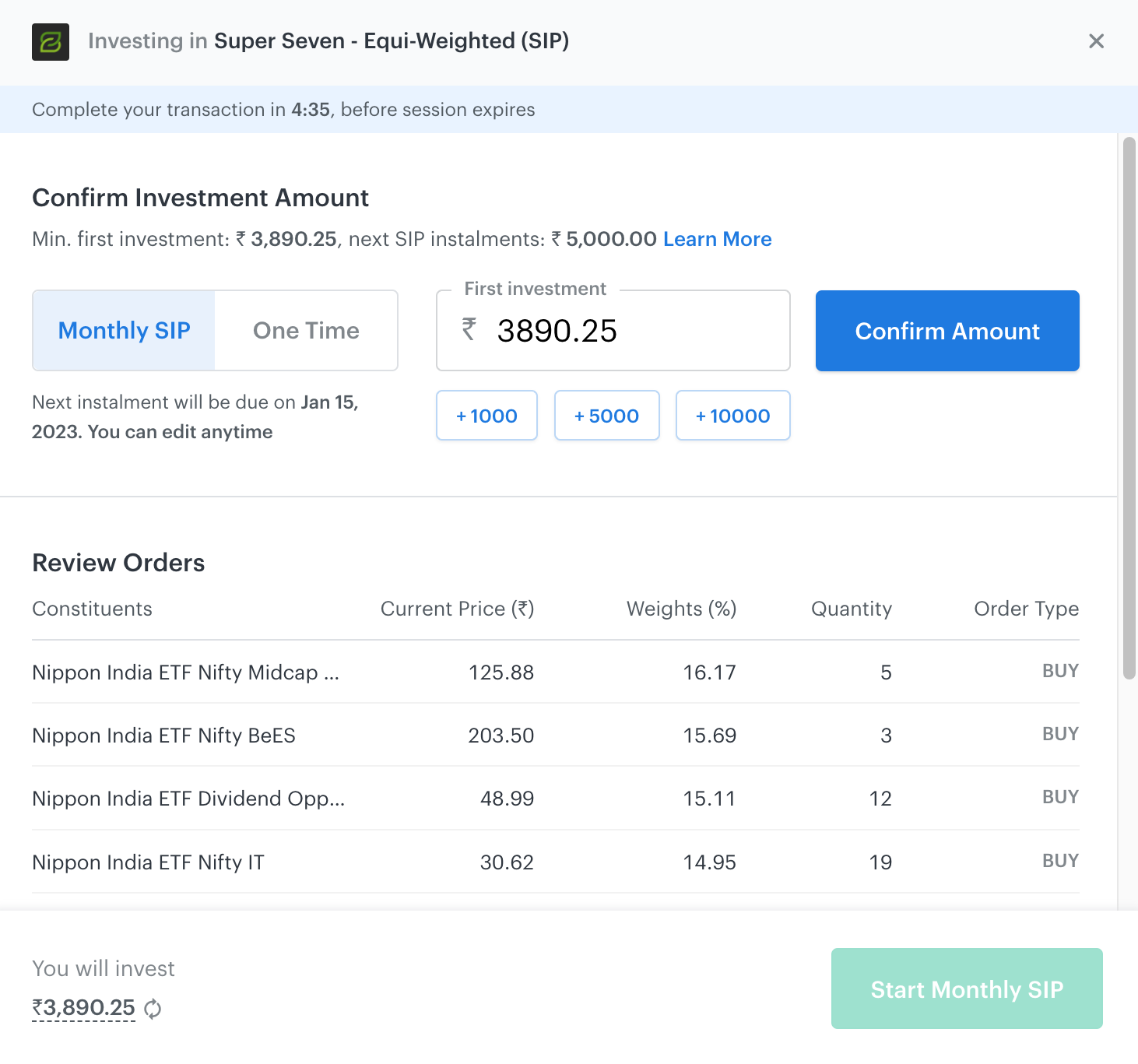

Okay, so in addition to the 3 smallcase versions we built, I've included a 4th combination - Rebalancing + SIP. or REBALSIP for short. (Sounds like Rebel Sip!)

Which is basically, a rebalancing, and then, SIPping of the same Smallcase. This is just for fun, and will be an interesting combination to watch.

Quite often, when we start to see losses, and we do not give the investment thesis sufficient time to pan out. Everyone wants to make money today, tomorrow, and brag at some party. This is not investing. Building wealth is a silent game.

And while timing of the market does make a difference, it is difficult for a normal person to execute consistently (which is why fund managers still have jobs!).

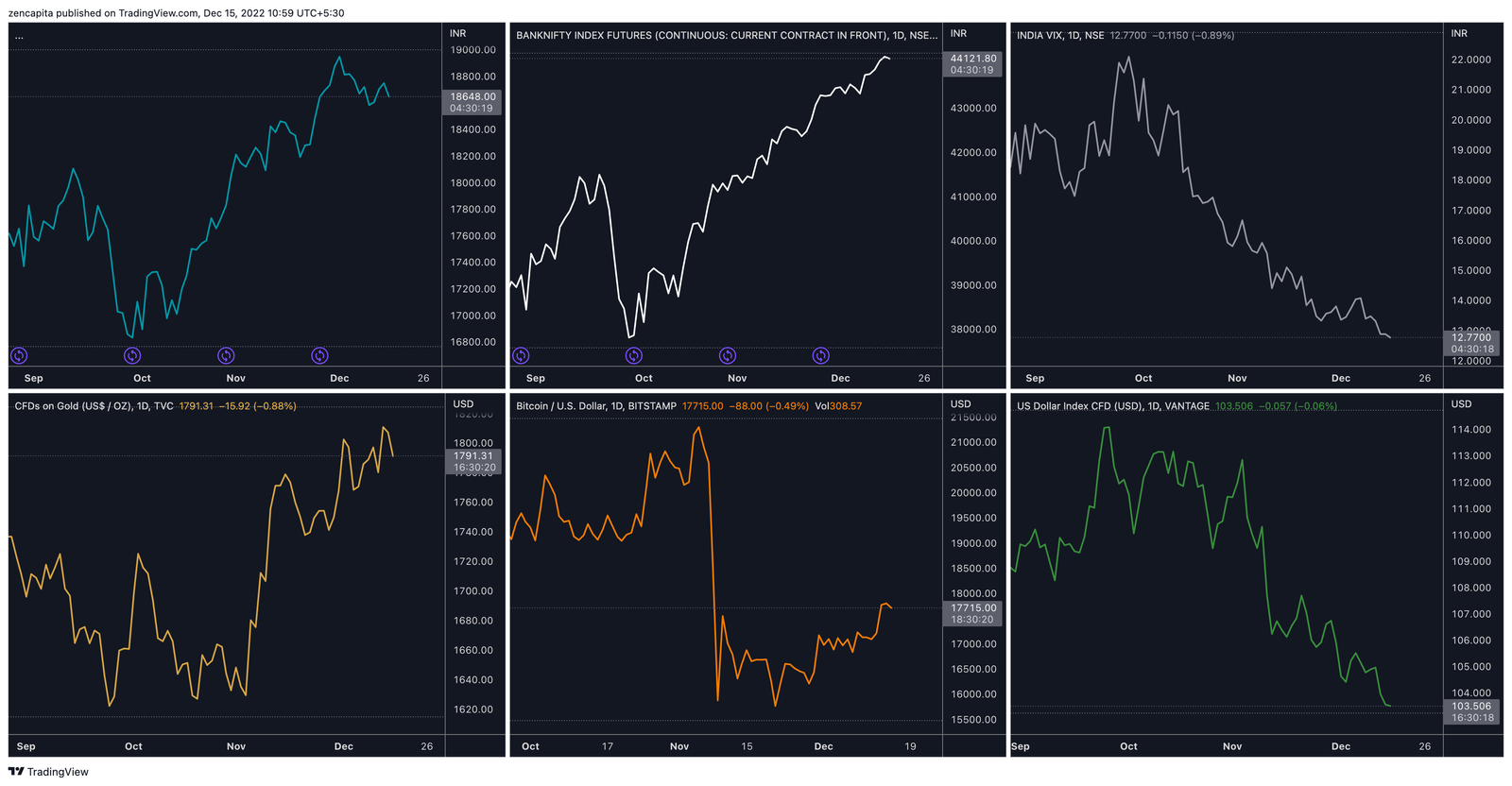

So even if we're investing at the peak of the market (see charts below), the power of SIPping or REBALANCING or both should be seen (if at all it exists).

What's more, is that we get to average down or rupee cost average into our position as the market corrects (my favourite time to invest). Some traders use the term - Keep Buying The Dip (KBTD) or Keep Buying The F*&^&*# [expletive] Dip (KBFD). Whether this is the right thing to do, is a discussion for another day.

So here's what you need to keep in mind when executing, select One Time for the Rebalance Smallcases, and Monthly SIP for the SIP Smallcases.

However, by keeping it simple, and consistently (i.e. with financial discipline) executing the process of investing, no matter what - you can see a different level of results. In 3 years, we hope to come to a conclusion.

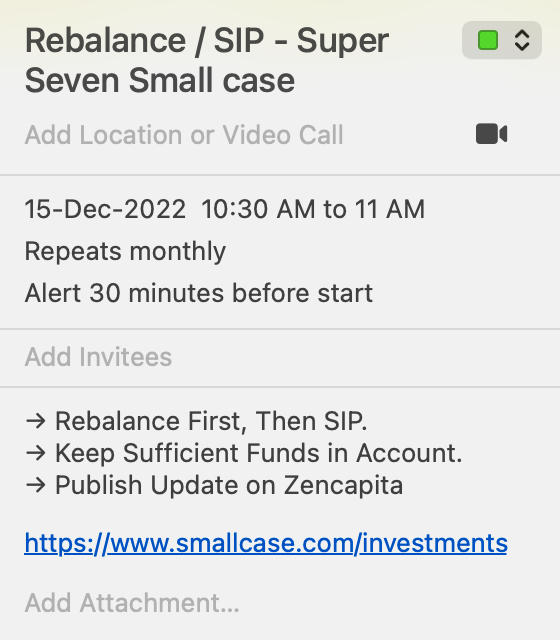

Now, we're going to take some extra steps to build that habit/discipline so we don't miss a rebalance or SIP. While Smallcase will give you a nudge on your WhatsApp (if you're connected) or your email. We're going to take an additional step, one which I recommend, introducing...

The Calendar

Yes, the humble Calendar. Open it, and just create a recurring event for REBALANCE/SIP and set it for 36 months or 36 recurring events. This way it will stay at the top of your mind.

That's a wrap! So if you wish to see the updates coming out, make sure you're subscribed (there's a free option). If you want to become a member, and dive deeper into what, why, and how I'm investing - become a paid subscriber.

Join other smart wealth builders today!

Since this may be your first time here, we're offering you 10% off our normal price, so you can get started. (Sorry no refunds).

Join us on this journey to building wealth, the smarter way.

So, without further ado. Please note that investing and trading is risk. Kindly read our disclaimer. Consult your own financial, tax and legal advisor.

Member discussion