Market View 20230719

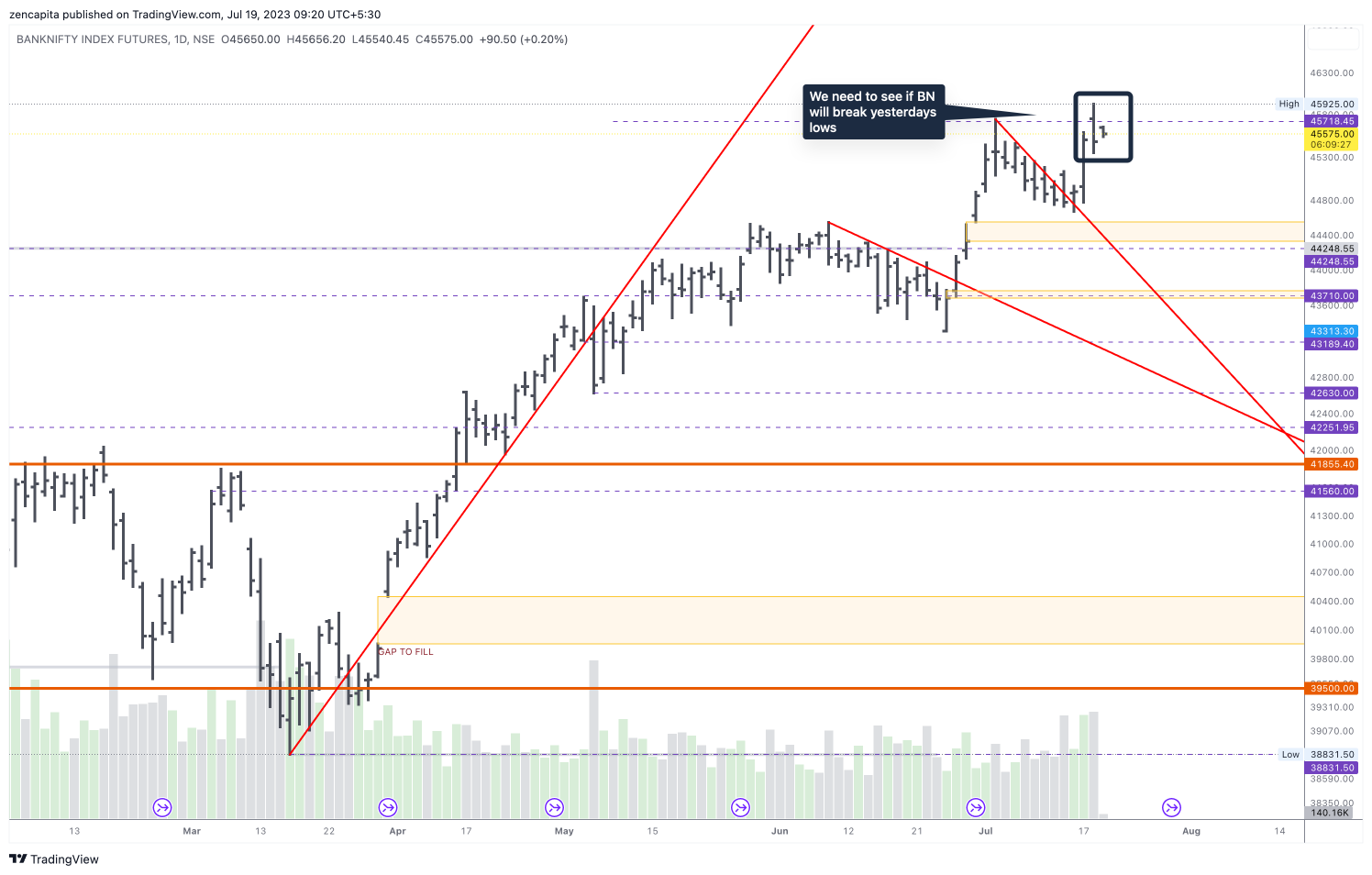

The only thing we need to wait for now, is to see if the BN will break yesterdays low, which was formed. Nothing further to add today, other than tomorrow is an expiry, so expect some profit booking.

205PM

So the BN has been going sideways today. Still below our volume profile point of control at 45733. This may continue until tomorrow, i.e. expiry.

Today also came across an interesting study/tweet on Twitter:

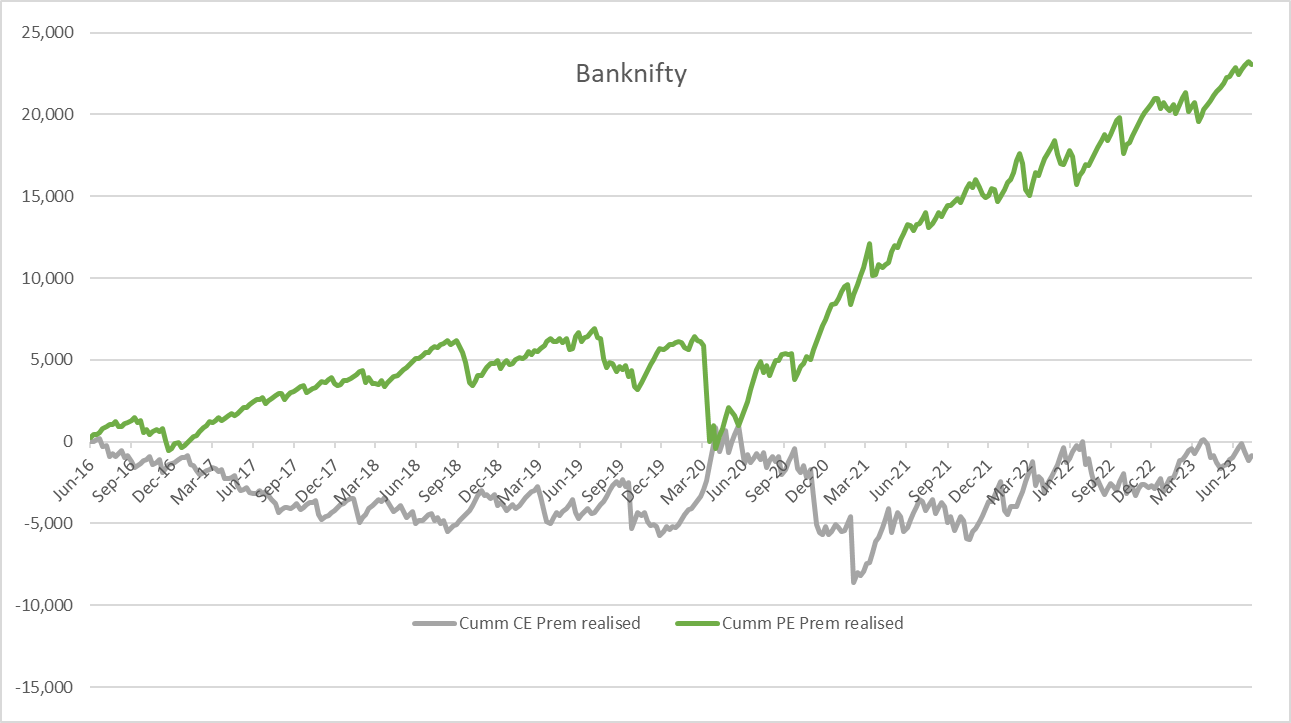

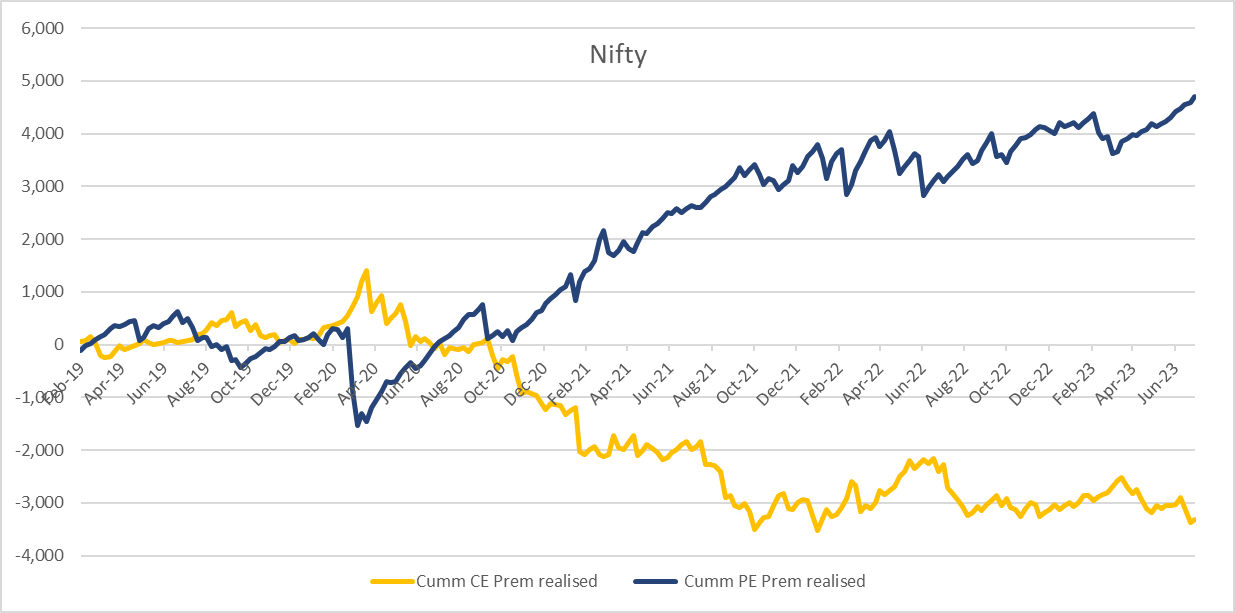

Why selling a call is statistically less profitable than selling puts.

— DineshK (@systemstrader1) July 18, 2023

Suppose you sell a Weekly straddle on Fri Morning (or on Mon if Fri is a holiday) and hold it till expiry. No Stop Loss, no targets just hold till expiry.

So, in short, selling PEs would be better than selling CEs. I don't disagree with this, because the market in general continues to move up and to the right over the long term. But a single blackswan event could cause some heart break.

Anyways Dinesh, suggests that both the BankNifty and Nifty follow a similar trend, though I would like to know why there is so much deviation post October 2020 on the Nifty and June 2020 in the Bank Nifty.

Member discussion