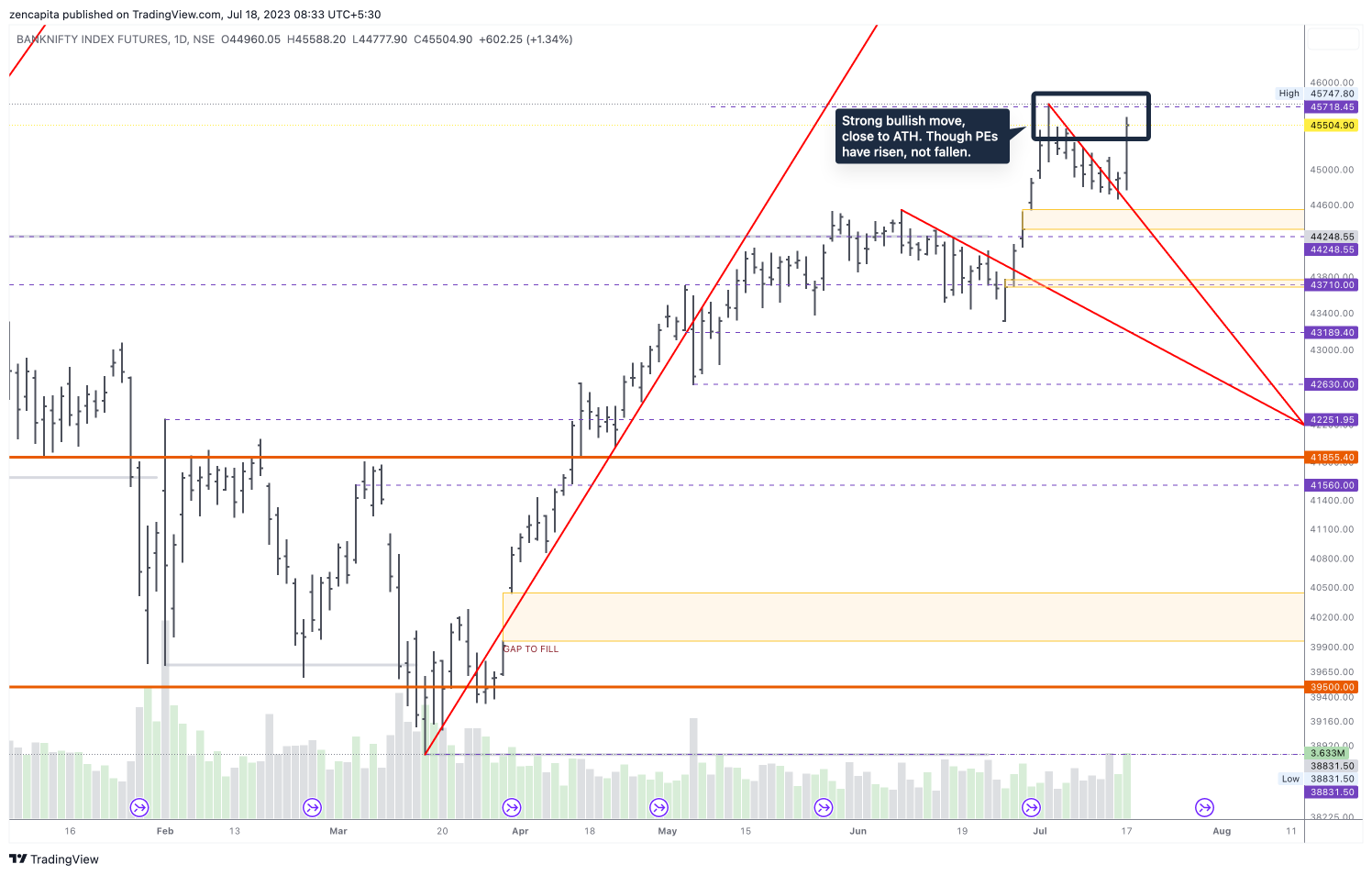

Market View 20230718

So yesterday, we got a massive short covering, by moving 600+ points up. Everyone who is short, or playing non-directional are closing their positions.

The volatility via the Indian Vix has also gone up. Now one thing could happen with such a move, it could go slightly higher today, and squeeze the rest of the shorters (bears), or non-directional traders who have positions for this Thursday expiry.

Yes, that means we might see this go higher until expiry, through either sideways movement or move higher, to cause enough pain to the shorters (bears) and non-directional players.

There is a saying:

The trend is your friend, until it ends.

And right now, the trend has not ended, so this is not over. Yesterday, I saw a swing from a fat profit to a loss. Will be adjusting today for the next week.

949AM

So we had an expected short covering again, this time another 400 points on the BN! This has pushed the BN to a new all time high. Now, will we sustain this move or will it go sideways from here, until Thursday?

I believe it will go sideways, trapping all the expiry traders. Because in just two sessions, the BN has moved 2%+ which is a lot.

Strangely enough, the global markets are also in sync, so now things all look great! (that was my sarcasm). This will probably be the most hated bull run in history.

When everyone is looking to short, the market will go up. Right now if you're doing your SIP, you should be good, as the value accumulates.

955AM

So now, let's move in to take some positions:

The volume profile is around 44870, lets say 44800 level is good for now. And let's look at open interest and decide on a position for next week. Most likely we will be selling PEs.

We have straddles forming now at 45,500 and support at 45000. So, 44800 seems to be a good level for PE.

And in August, all CE, so that means the market isn't looking to move higher than these levels. i.e. from 46000 <> 48500. With support only at 43000. That's wide, but severly bearish.

So we can either take 44500 or more aggressively 44800 as support.

1122AM

One of the key things to look out for, is if the market is holding up for the first hour or two, the strength exists. Only in some cases could it fall post noon. We can see from the above that its holding the range. So we're going to be here for the rest of the day, unless something happens post 12 or 130 pm when the global markets open up.

1225PM

So that ended fast, post noon, we're actually down today. From 400 points up, to 50 points down!

224PM

So here's an interesting observation: Closed my PE position as the market was up by about 400 points. But as the market corrects, the PE positions lose more value!

Member discussion