Here's why Indian Crypto Investors & Traders could lose as much as 20% before even getting started.

In my previous post, I talked about the restrictions that could come by way of regulation from central banks and governments. Well ignoring that, and the need to tax, traders and investors in cryptocurrency would have a tough time trying to make enough returns to even consider it a worthy investment. Here's why...

I did an (actually two) experiment with real money, my own money so that I could test all the hoohaa of Bitcoiners and cryptocurrency advocates believers.

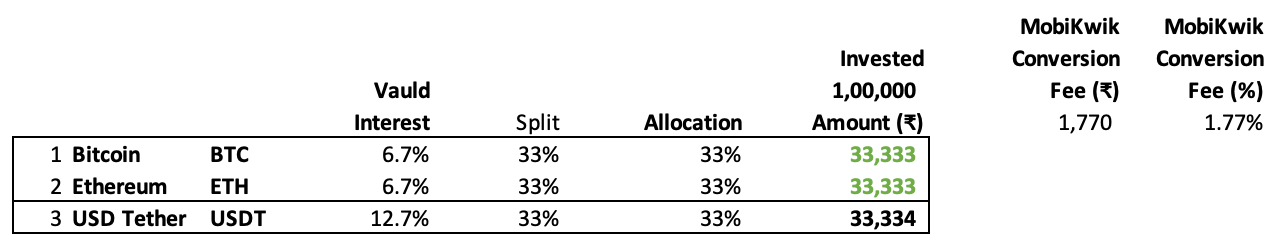

I first tested with ₹1 lakh to buy multiple coins, so that I could lend them on Vauld (click here for non-affiliate link) and generate some interest, and then realized there were some issues with WazirX (click here for non-affiliate link) and so I tested again with another ₹1 lakh to see if it was a one-off, and with a more equiweighted quantity - to help compare apples with apples.

And in India, with all the confusion caused by the government, there was no better time than now to test how practical it is to invest/trade/exchange in cryptos.

These sort of things are not shared by those pushing educating on cryptos, because 1) they have affiliate links that make them money or 2) they have cryptos and need to see them go up, so they can sell.

I risk my own money, and you get to see how I see things as an investor or trader. (Pssst... if you're really interested to know more, please do become a member).

So, on with the findings of this experiment.

Let me say this upfront as a disclaimer, this is not always going to be the case, tomorrow one of these platforms could change their stance after my publishing and render this whole post irrelevant. Plus, cryptos are high-risk speculation, get your own advisor, please.

The process is simple, transfer money from your bank account to your crypto exchange and buy cryptos.

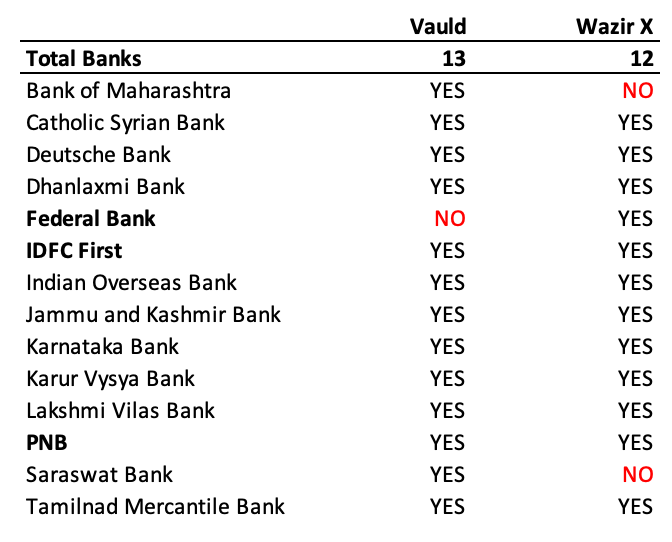

However, thanks to the Indian government's lack of clarity and confusion inducing announcements, this has led well-known banks such as SBI, HDFC Bank, ICICI Bank, and Axis Bank refusing to work with crypto platforms. (Even Kotak Mahindra bank that was gung-ho about cryptos, took a back seat post their announcement).

So of the list of 'supported banks', there are only three banks that are part of the BankNifty Index.

Why you may ask?

Ask your bank, and knowing all too well they won't have an answer, ask your politician or tweet directly to the finance minister and the prime minister.

This leaves you with a few banks on the platform from which you can transfer funds. I did notice, that these are probably non-systemic banks a.k.a. not the too-big-to-fail banks.

Anyways, here are the coins I identified and thought of acquiring, and their split.

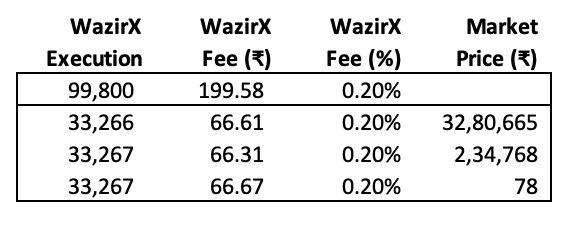

And in order to get money from banks which were not supported, I only found WazirX provide a MobiKwik Wallet option. Fair enough, that 'convenience' despite being passed through UPI, cost me 1.77% of the transferred amount.

So, here's my first observation: From transferring from your bank account to actually acquiring cryptos on WazirX, you're losing around 2% including MobiKwik's convenience fee (1.77%) and WazirX's transaction fee (0.2%).

In other words, for every ₹1,00,000 (1 lakh) that you invest, you only get ₹98,030 worth of cryptos, i.e. you lose 1.97%, say 2% for argument's sake.

Things get worse from here on...

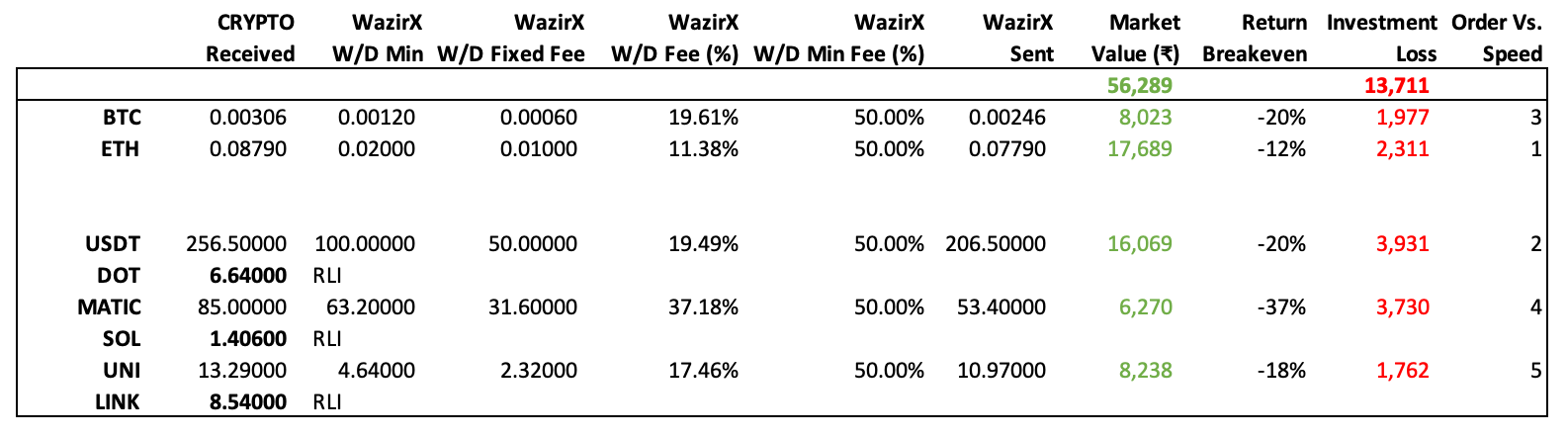

As you can see, I identified a couple of tokens/coins to invest in. And here's where WazirX's lack of transparency, can piss you off!

Second observation: I just wish WazirX had indicated somewhere before buying the crypto, that withdrawals for the coins I was buying are suspended and that I can only transfer to Binance as part of RLI (Rapid Listing Initiative).

Now that pisses me off! So let's leave it there.

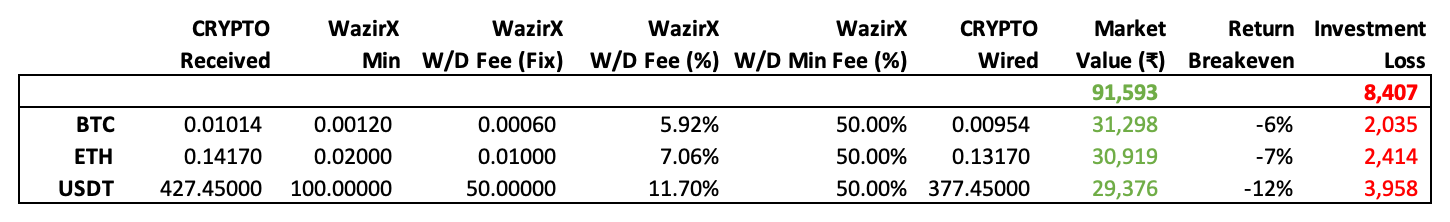

Please study the end result of the cryptos received, and the fees paid.

As you can see from the above, I got stuck with some coins, which I couldn't transfer out from WazirX (marked RLI). So this made my comparison difficult.

I also kept an eye on the speed of transfer and noticed that ETH and USDT were the faster of the lot, followed by BTC. In the above, the break-even return means how much I lost from the original investment, in order for me to break even.

WazirX has a minimum withdrawal amount. That really sucks. But what is worse, is that their withdrawal fees are 50% of that minimum withdrawal amount, coincidently!

As the amount of investment is small, you lose a higher percentage, mostly due to the fixed fee nature of WazirX irrespective of the transfer amount.

This is what will kill your investment. I hope WazirX will reconsider this for the sake of small investors trying to build their crypto portfolio.

Third observation: On average, from deposit to investment, you could lose around 20% through transaction fees, even higher, as in the case of MATIC (Polygon) it was high as 37%. Imagine...

Ultimately, I converted my DOT, SOL, and LINK to ETH at a small loss, and then withdrew this to Vauld to place on an ETH deposit there. Converting back to DOT, SOL or LINK would be an additional cost, so didn't bother.

Fourth observation: While you may get 12.68% or 7.23% as interest on Vauld for your coins, the cost of transfer is sometimes higher, and so you will never make money in the short term on your crypto investments, as great as it sounds, unless you're betting on capital gains, rather than yield.

I did the same experiment the next day, as I had to wait because MobiKwik has a limit of ₹1 lakh per day via UPI.

So here's the same experiment with an equal-weighted amount of BTC, ETH, USDT. You can see the percentage loss is smaller, because of a larger allocation to fewer cryptos. But you still lose around 10% from deposit to investment.

So for every ₹1 lakh invested, I've lost around ₹8,400 which is around 8%, but when I factor in the cost of MobiKwik Wallet's convenience fee of almost 2% – that's a 10% loss before I even get started.

Of course, if you're transferring directly from a 'supported' bank directly to your crypto platform of choice, things might be better. But be careful when wiring your cryptos out of that platform. That's when 'gas' fees can get expensive.

I'm a strong believer in cryptos, particularly from what I've seen going on with the current monetary system. But do you really think governments or central banks will be open to it?

I will probably have to say goodbye to this investment, as either I'll lose the key to my wallet or the government will tax it to zero! (Sarcasm implied).

Disclosure: I was an investor in Vauld and exited months before this analysis, so there is no conflict of interest in the above analysis.

Member discussion